Loans are necessary for the formation, operation, development, and improvement of all commercial companies.

A vendor is a crucial part of a supply chain network. Vendors supply raw goods that are required for manufacturing products.

... applications

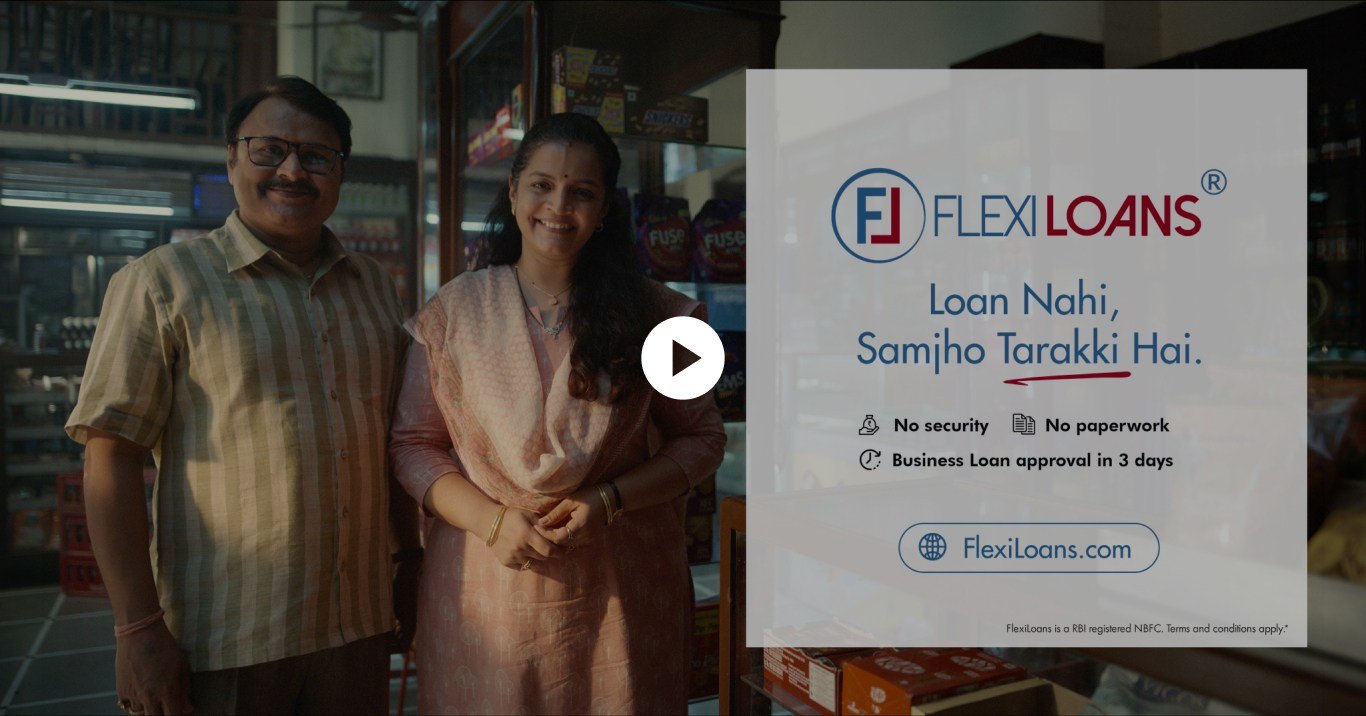

Tension free loans as you do not have to provide any security

Minimum document and easy process

We follow RBI mandate policies to safeguard and store your data

We mention all the charges up front before disbursement. No surprises later!

People love our products

Security & support you can trust

Anti Phishing

FlexiLoans never ask for money to reduce your interest rate or processing your application faster.

Responsibility

We never sell or share your data with the marketing companies and 3rd party

Serious security

We follow industry leading security system to keep our data safe on the internet

Why FlexiLoans

FlexiLoans which is a brand owned by Epimoney Private Limited an RBI registered NBFC offers quick and hassle-free business loans without any collateral and paperwork. Whether you're a trader, retailer, service provider, or manufacturer, our loans are designed to help you grow.

Our customers love us...

Our achievements

India Winner in Gold Category

2018-2019

Digital Lending NBFC of the Year

Millennials Awards 2019

India Winner in Gold Category

2018-2019

Recent Blogs/Media coverage

FAQ

- Expanding your business

- Servicing regular working capital needs

- Managing seasonal working capital requirements

- Manage short term cash flow gaps

We are an RBI Registered NBFC*

We are an RBI Registered NBFC*

We never sell or share your data with the marketing companies and 3rd party

We never sell or share your data with the marketing companies and 3rd party