Oct 22, 2025

Nov 28, 2025

Discover how MSMEs in Chennai can secure fast, collateral-free business loans with flexible repayment options in 2025

Authored By FlexiLoans | Date: 22/10/2025

- Quick Summary

- What: Guide to obtaining unsecured business loans in Chennai without pledging collateral.

- Why: Helps local MSMEs access quick working capital or expansion funds without risking property or assets.

- Who: Traders, retailers, service providers, and manufacturers across Chennai and Tamil Nadu.

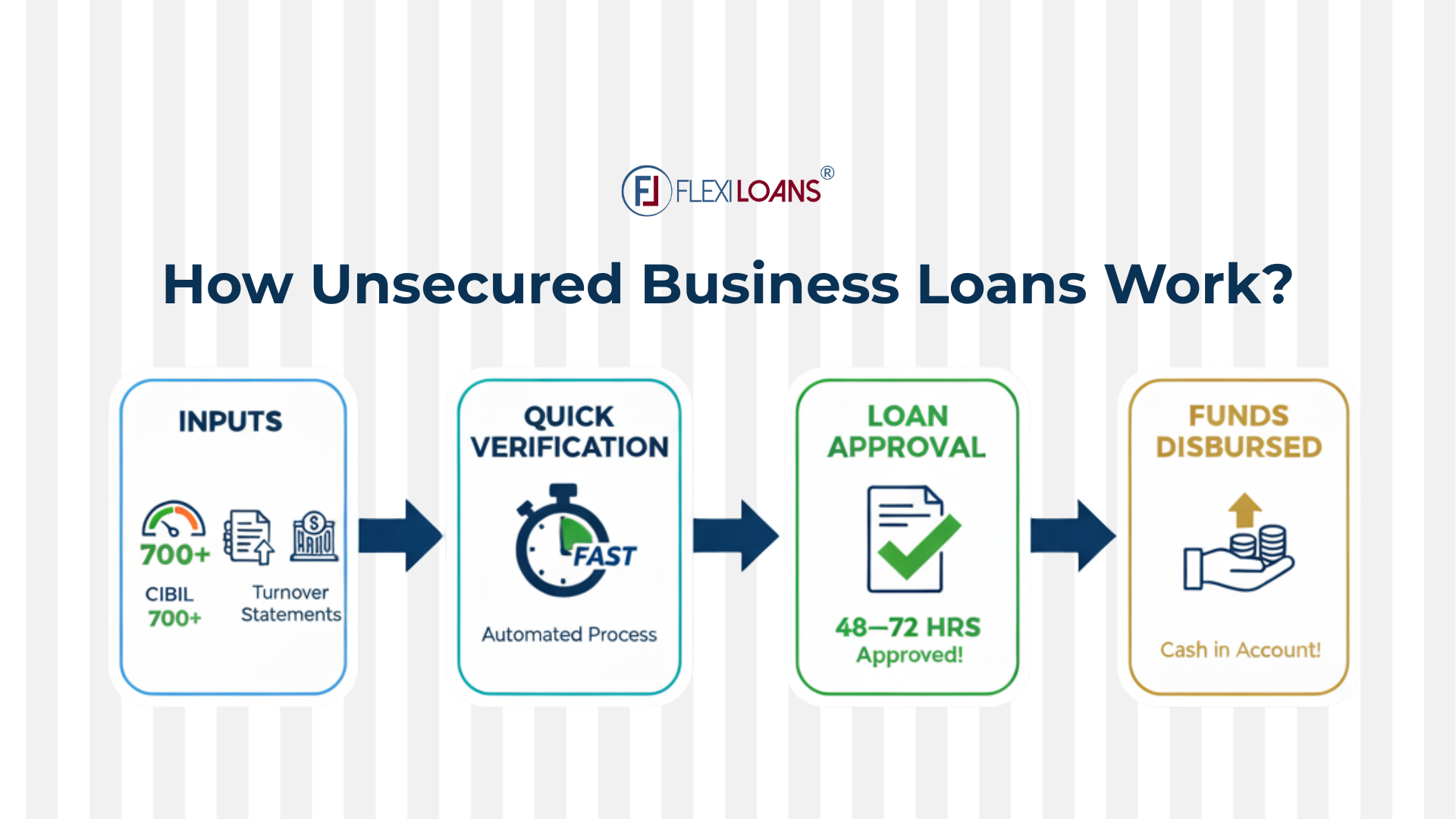

- How: Check eligibility, apply online with NBFCs like FlexiLoans, and receive funds within 48–72 hours.

- Use Case: A textile wholesaler in T. Nagar secures ₹12 lakh within 72 hours through an unsecured business loan, funding bulk stock purchases ahead of the festive season.

Chennai’s MSME ecosystem is one of the strongest in India, with thriving sectors like textiles, automotive components, logistics, and IT-enabled services. For many of these businesses, timely access to credit is crucial for managing seasonal demand, expanding operations, or addressing working capital gaps.

However, traditional loans often require collateral, such as land or machinery, a roadblock for many small and medium-sized enterprises. That’s where unsecured business loans in Chennai come in. These loans are designed to provide quick, collateral-free funding with minimal paperwork and faster approval cycles. In 2025, digital-first NBFCs and fintech lenders, such as FlexiLoans, are making it easier for Chennai-based businesses to grow without risking their assets.

What Are Unsecured Business Loans?

An unsecured business loan is a funding option that does not require borrowers to pledge any assets, such as property, machinery, or inventory. Instead, approval depends on the applicant’s credit score, turnover, and business performance.

For MSMEs in Chennai, whether you run a textile unit, logistics company, or retail outlet, unsecured loans offer a quick way to access working capital while keeping your assets safe.

Why Chennai Businesses Prefer Unsecured Loans in 2025?

Chennai’s economy thrives on industries like textiles, IT services, automobile components, and trade hubs. Cash flow challenges often arise due to seasonal demand, vendor payments, or the need for expansion.

Unsecured loans are popular in Chennai because they:

- Save time by avoiding property-based collateral checks.

- Suit SMEs working in rental spaces (common in urban centres).

- Provide flexible loan amounts (₹50,000 – ₹50 lakh).

- Support businesses in competitive industries where quick funding is crucial.

What are the Key Benefits of Unsecured Business Loans?

- No Collateral Needed – Perfect for MSMEs without high-value assets.

- Fast Approval & Disbursal – Loans are usually approved and credited within 48–72 hours.

- Flexible Loan Amounts – Borrow from ₹50,000 to ₹50 lakh based on your business requirements.

- Digital Process – Fully online application, KYC, and document submission.

- Customised Repayment – EMIs aligned with your monthly cash flow.

- Use Anywhere – Funds can be used for working capital, inventory, marketing, expansion, or vendor payments.

Eligibility Criteria & Documents Required

Eligibility (Indicative for 2025):

- Minimum business vintage: 2 years.

- Monthly turnover: ₹2 lakh or above.

- CIBIL score of 700+.

- An Indian citizen, aged between 21 and 60 years.

Documents Required (Digital Uploads):

- PAN card & Aadhaar card (KYC).

- Business registration/license.

- Last 6–12 months’ bank statements.

- GST returns (if applicable).

What are the Average Interest Rates for Unsecured Business Loans in Chennai? (2025)

Interest rates for unsecured business loans vary depending on the lender and borrower profile.

| Lender Type | Typical Interest Rate (p.a.) | Segment |

| Public Banks | 12% – 16% | Larger businesses with strong credit history |

| Private Banks | 14% – 20% | SMEs with stable cash flow |

| NBFCs & Fintechs | 15% – 24% | MSMEs, retailers, traders, service providers |

At FlexiLoans, unsecured business loans start from 1% per month, customised according to turnover, creditworthiness, and repayment ability.

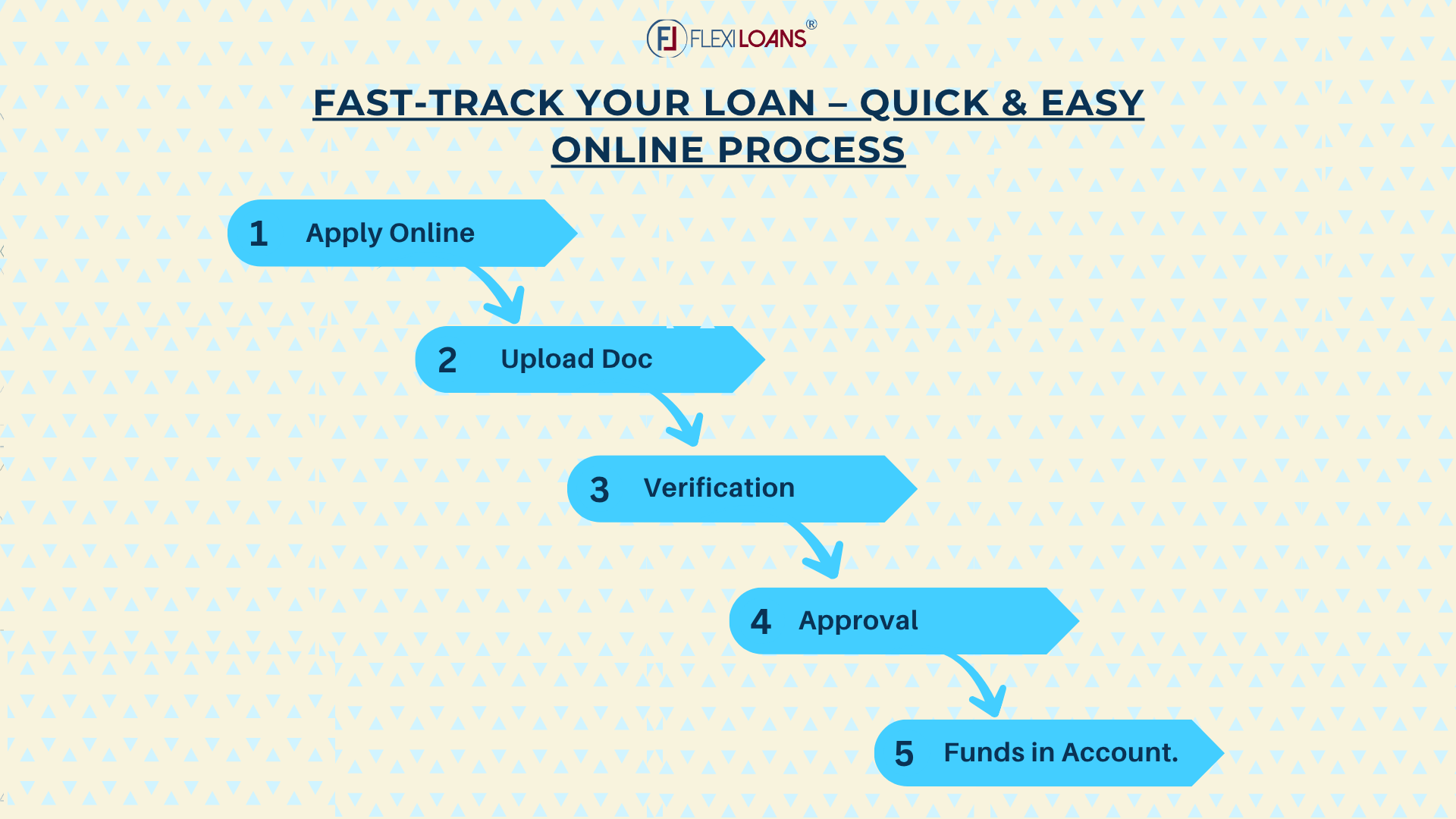

Application Process: How to Apply Online in Chennai

Applying for an unsecured business loan in Chennai through FlexiLoans is fast and straightforward:

- Check Eligibility

Minimum 2 years’ vintage, ₹2 lakh turnover, CIBIL 700+.

- Keep Documents Ready

PAN, Aadhaar, GST, and bank statements.

- Apply Online

Visit the FlexiLoans Unsecured Loan Page and fill out the form.

- Upload Documents

Securely share KYC and financial records.

- Verification – Digital verification within a few hours.

Digital verification within a few hours.

- Approval & Disbursal

Loan sanctioned and disbursed in 48–72 hours.

Why Choose FlexiLoans for Your Unsecured Business Loan in Chennai?

When it comes to obtaining unsecured business loan funding in Chennai, FlexiLoans is designed to meet the needs of Chennai’s MSMEs. Here’s why thousands of business owners trust us:

- Quick Disbursal – Funds are credited to your account within 48-72 hours of approval, allowing you to act on opportunities immediately.

- Minimal Documentation – Apply with just the essential documents, such as KYC, bank statements, and GST returns, all in digital format.

- Collateral-Free Loans – Access funding without pledging personal or business assets.

- Transparent Process – No hidden charges or surprise fees; every detail is shared upfront.

- Flexible Loan Amounts – Borrow anywhere from ₹50,000 to ₹50 lakh based on your needs.

- Repayment on Your Terms – Select EMI options that align with your business’s cash flow for stress-free repayment.

- Sector-Focused Lending – Our data-driven approach ensures loan solutions are tailored to the unique needs of your industry.

Pro Tips for a Successful Online Loan Application

1. Maintain a Healthy CIBIL Score

Aim for a score above 700 to improve your chances of approval and secure better interest rates from lenders.

2. Apply for the Right Amount

Borrow only what your business genuinely needs to avoid over-leveraging and unnecessary interest costs.

3. Keep All Documents Ready in Digital Format

Store GST returns, bank statements, and KYC documents in PDF format for easy upload during the application process.

4. Compare Interest Rates and Tenure Before Applying

Check multiple online lenders to find a repayment plan that aligns with your cash flow and growth plans.

5. Be Honest in Your Application

Any discrepancies in your application information can delay approval or result in rejection.

In Chennai’s fast-moving industries, unsecured business loans help MSMEs seize opportunities without risking property. With fintech lenders like FlexiLoans, approvals are quicker, safer, and built for the digital-first business environment.

Conclusion

Unsecured business loans in Chennai are transforming how MSMEs fund operations and expansion. With no collateral, quick approvals, and minimal paperwork, they provide the flexibility business owners need to stay competitive. Choosing a trusted NBFC like FlexiLoans ensures transparent terms, fast disbursal, and funding tailored to Chennai’s unique business ecosystem.

FAQs: Unsecured Business Loans Chennai 2025

An unsecured business loan is a type of funding where MSMEs in Chennai can borrow without having to pledge property or machinery. Approval depends on turnover, CIBIL score, and financial health.

Business owners with at least 2 years of operations, a monthly turnover of ₹2 lakh or more, and a CIBIL score of 700 or above can apply.

With FlexiLoans and other digital-first lenders, loan approval and disbursal typically happen within 48–72 hours after verification.

NBFCs and fintechs usually charge between 15% to 24% p.a. FlexiLoans offers customised rates starting from 1% per month, depending on your profile.

No. Unsecured loans are collateral-free, making them ideal for SMEs that do not want to risk assets.

You’ll need PAN and Aadhaar (KYC), GST returns (if applicable), last 6–12 months’ bank statements, and business registration proof.

Yes. Funds can be used for inventory purchase, vendor payments, seasonal stocking, marketing, or expansion.

Because FlexiLoans offers fast disbursal (48–72 hrs), minimal documentation, transparent terms, and collateral-free loans tailored to MSMEs across Chennai.

Glossary – Key Terms Explained

| Term | Definition |

| Unsecured Loan | Loan without pledging property or assets. |

| CIBIL Score | Credit score (300–900) showing repayment history; 700+ preferred. |

| Disbursal Time | The duration between approval and money being credited (48–72 hrs). |

| Collateral-Free Loan | Funding without security, based on creditworthiness. |

| NBFC | Non-Banking Financial Company, a key lender for MSMEs. |

| KYC | Know Your Customer – ID verification process (PAN, Aadhaar). |

| Working Capital Loan | Short-term loan to meet daily business needs. |