Oct 23, 2025

Nov 28, 2025

A detailed guide to unsecured business loans in India, covering benefits, eligibility, and how MSMEs can apply online in 2025

Authored By FlexiLoans | Date: 23/10/2025

- Quick Summary

- What: Overview of unsecured business loans in India—loans without collateral.

- Why: Helps MSMEs access fast funding for growth without risking property or assets.

- Who: MSME owners, traders, service providers, and small manufacturers.

- How: Learn eligibility, average interest rates, and how to apply online through leading NBFCs like FlexiLoans.

- Use Case: A wholesale distributor secures ₹15 lakh in 72 hours for seasonal stock, without pledging property as collateral.

For MSMEs, maintaining liquidity is often the biggest challenge. From purchasing raw materials to paying salaries and managing seasonal demand, funding gaps are a common occurrence. Traditionally, lenders have required collateral, such as property or machinery, to extend credit. But for many small businesses, pledging assets is not feasible.

This is where unsecured business loans in India have become a game-changer. These loans allow MSME owners to borrow without collateral, with quick approvals and a simple online application process. In 2025, NBFCs and fintech platforms, such as FlexiLoans, are making access to unsecured loans faster, safer, and more transparent than ever.

What Are Unsecured Business Loans in India?

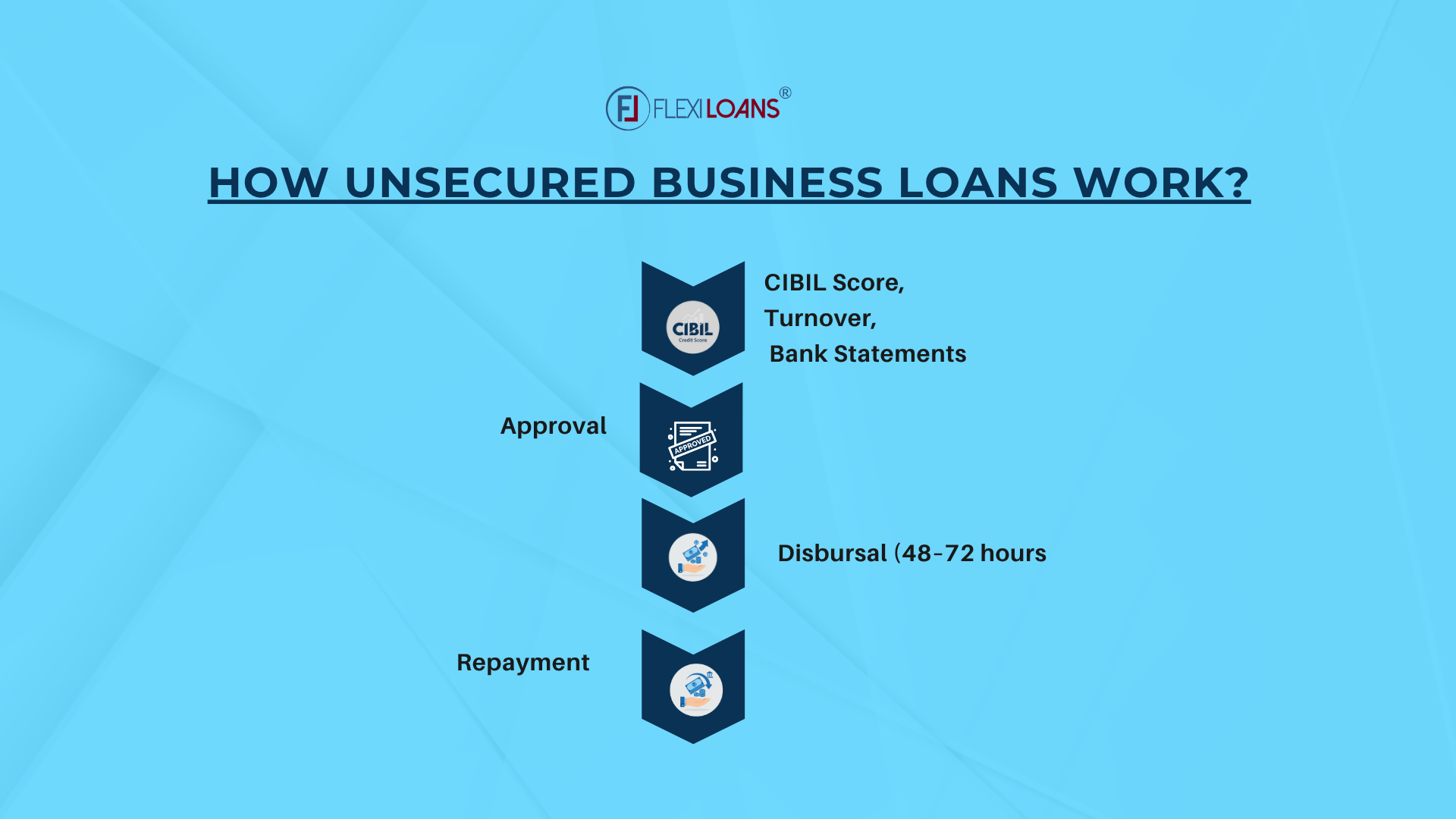

An unsecured business loan is a type of loan where you don’t have to pledge collateral, such as property, equipment, or inventory, as security. Instead, approval is based on factors such as credit score, monthly turnover, and business performance.

For MSMEs, these loans serve as a lifeline, offering quick access to funds for working capital, expansion, or managing cash flow gaps without risking assets. In India, unsecured loans are usually offered by NBFCs and fintech platforms that specialize in MSME financing.

What are the Differences Between Secured vs. Unsecured Business Loans?

| Feature | Secured Business Loan | Unsecured Business Loan |

| Collateral Required | Yes (property, assets, guarantees) | No collateral required |

| Approval Time | Weeks (due to asset verification) | 48–72 hours |

| Loan Amounts | Higher, depending on collateral value | ₹50,000 to ₹50 lakh (flexible) |

| Risk for Borrower | Risk of losing the asset if repayment defaults | No asset risk, but higher interest |

| Interest Rates | Lower due to reduced risk | Slightly higher, based on credit profile |

This clear difference makes unsecured business loans the preferred choice for MSMEs that don’t want to risk assets or wait weeks for approval.

What are the Key Benefits of Unsecured Business Loans?

- No Collateral Needed – Perfect for MSMEs without high-value assets.

- Fast Approval & Disbursal – Loans are usually approved and credited within 48–72 hours.

- Flexible Loan Amounts – Borrow from ₹50,000 to ₹50 lakh based on your business requirements.

- Digital Process – Fully online application, KYC, and document submission.

- Customised Repayment – EMIs aligned with your monthly cash flow.

- Use Anywhere – Funds can be used for working capital, inventory, marketing, expansion, or vendor payments.

Eligibility Criteria & Documents Required

Eligibility (Indicative for 2025):

- Minimum business vintage: 2 years.

- Monthly turnover: ₹2 lakh or above.

- CIBIL score of 700+.

- An Indian citizen, aged between 21 and 60 years.

Documents Required (Digital Uploads):

- PAN card & Aadhaar card (KYC).

- Business registration/license.

- Last 6–12 months’ bank statements.

- GST returns (if applicable).

What are the Average Interest Rates for Unsecured Business Loans in India (2025)

Interest rates for unsecured business loans vary depending on the lender and borrower profile.

| Lender Type | Typical Interest Rate (p.a.) | Segment |

| Public Banks | 12% – 16% | Larger businesses with strong credit history |

| Private Banks | 14% – 20% | SMEs with stable cash flow |

| NBFCs & Fintechs | 15% – 24% | MSMEs, retailers, traders, service providers |

At FlexiLoans, unsecured business loans start from 1% per month, customised according to turnover, creditworthiness, and repayment ability.

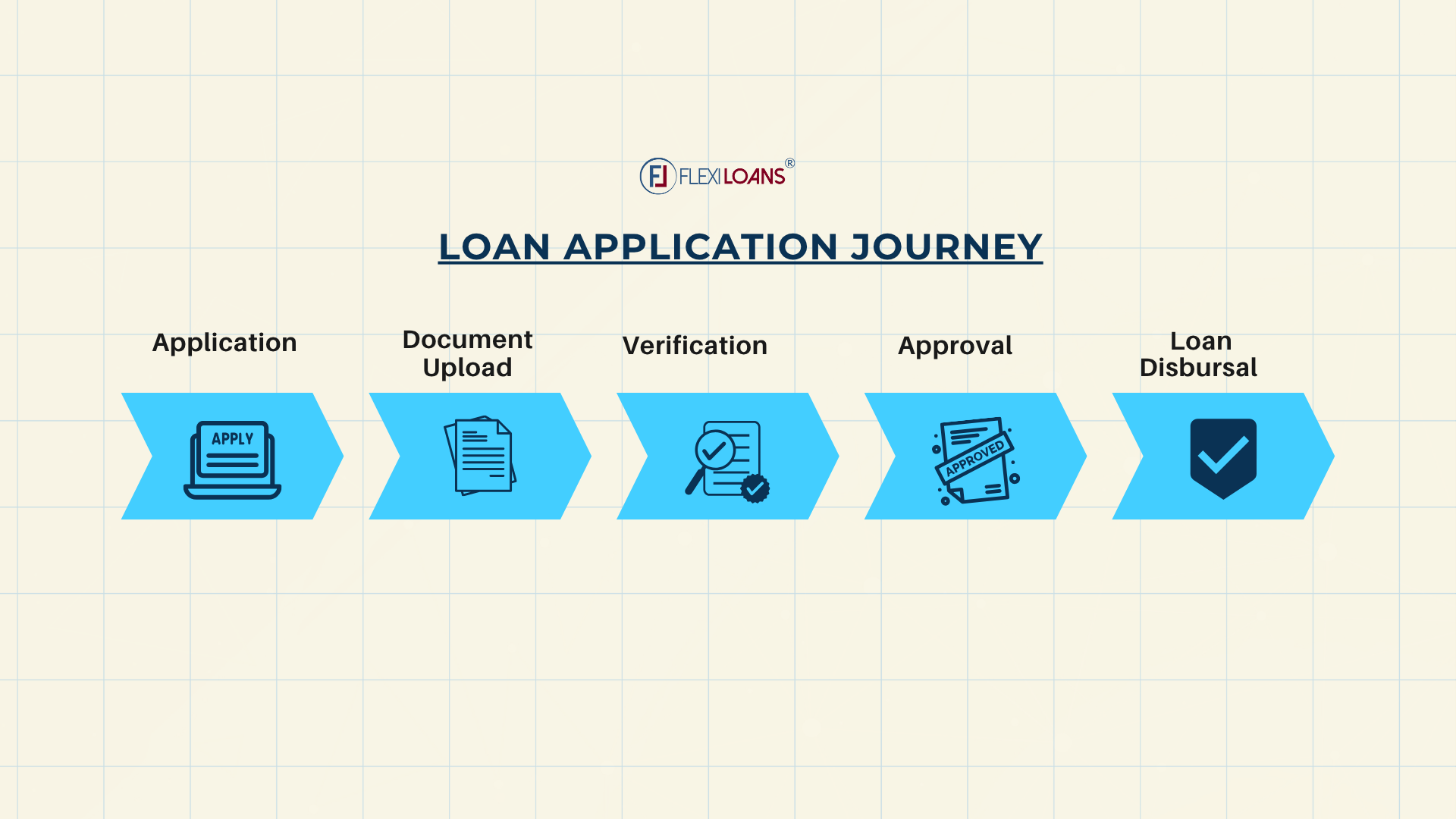

Application Process: How to Apply Online in 2025

Applying for an unsecured business loan is quick and hassle-free with digital-first lenders like FlexiLoans. Here’s how the process works:

- Check Your Eligibility

Ensure you meet the basic requirements:

-Minimum business vintage of 2 years.

-Monthly turnover of at least ₹2 lakh.

-CIBIL score of 700+ (NBFC-friendly).

-No collateral required for most FlexiLoans products - Prepare Your Documents in Digital Format

Keep the following ready in scanned or PDF form:

-Aadhaar and PAN card (KYC).

-Last 6–12 months of bank statements.

-GST returns (if applicable).

-Business registration or license. - Fill Out the Online Application Form

-Visit the FlexiLoans application page.

-Enter basic business and personal details.

-Upload your documents securely through the portal. - Complete KYC & Verification

Most verifications are completed within a few hours.

- Receive Loan Approval & Disbursal

-Approved applicants receive a digital sanction letter.

-Funds are credited directly to your business account, often within 48-72 hours.

Why Choose FlexiLoans for Your Unsecured Business Loan?

When it comes to obtaining unsecured business loan funding, FlexiLoans is designed to meet the needs of India’s MSMEs. Here’s why thousands of business owners trust us:

- Quick Disbursal – Funds are credited to your account within 48-72 hours of approval, allowing you to act on opportunities immediately.

- Minimal Documentation – Apply with just the essential documents, such as KYC, bank statements, and GST returns, all in digital format.

- Collateral-Free Loans – Access funding without pledging personal or business assets.

- Transparent Process – No hidden charges or surprise fees; every detail is shared upfront.

- Flexible Loan Amounts – Borrow anywhere from ₹50,000 to ₹50 lakh based on your needs.

- Repayment on Your Terms – Select EMI options that align with your business’s cash flow for stress-free repayment.

- Sector-Focused Lending – Our data-driven approach ensures loan solutions are tailored to the unique needs of your industry.

Pro Tips for a Successful Online Loan Application

- Maintain a Healthy CIBIL Score

Aim for a score above 700 to improve your chances of approval and secure better interest rates from lenders. - Apply for the Right Amount

Borrow only what your business genuinely needs to avoid over-leveraging and unnecessary interest costs. - Keep All Documents Ready in Digital Format

Store GST returns, bank statements, and KYC documents in PDF format for easy upload during the application process. - Compare Interest Rates and Tenure Before Applying

Check multiple online lenders to find a repayment plan that aligns with your cash flow and growth plans. - Be Honest in Your Application

Any discrepancies in your application information can delay approval or result in rejection.

In 2025, unsecured business loans are bridging the gap for MSMEs that lack collateral but need quick funding. With NBFCs like FlexiLoans, business owners can focus on growth instead of worrying about risking assets.

Conclusion

Unsecured business loans in India are a vital resource for MSMEs that require rapid, flexible, and collateral-free funding. By choosing trusted NBFCs like FlexiLoans, you can access capital within 72 hours, manage your working capital effectively, and expand your business without risking personal or business assets.

FAQs: Unsecured Business Loans India 2025

Unsecured business loans are loans provided without requiring collateral, such as property or machinery. Approval is based on your business’s financial health, turnover, and CIBIL score.

MSMEs with at least 2 years of operational history, a minimum monthly turnover of ₹2 lakh, and a CIBIL score of 700+ are typically eligible.

With NBFCs and fintech lenders like FlexiLoans, loans are usually disbursed within 48–72 hours of approval.

Yes. Since there’s no collateral, interest rates are slightly higher than secured loans. However, lenders like FlexiLoans offer competitive, transparent rates starting from 1% per month.

You’ll need PAN, Aadhaar, business registration proof, last 6–12 months of bank statements, and GST returns (if applicable).

Absolutely. These loans are widely used for working capital, inventory purchase, vendor payments, marketing expenses, or business expansion.

FlexiLoans provides fast disbursal (48–72 hours), minimal documentation, collateral-free funding, and repayment plans customised to MSME cash flows.

Glossary: Key Terms Explained

| Term | Definition |

| Unsecured Business Loan | Loan provided without collateral, based on business performance and credit score. |

| Secured Loan | A loan backed by collateral, such as property or equipment. |

| CIBIL Score | A 3-digit number (300–900) reflecting creditworthiness; 700+ is preferred. |

| NBFC | Non-Banking Financial Company offering loans without a banking license. |

| KYC | Know Your Customer – identity verification through PAN, Aadhaar, etc. |

| Disbursal Time | The time it takes for loan funds to be credited after approval. |

| Collateral-Free Loan | A loan that doesn’t require the borrower to pledge assets. |

Is this information helpful?