Feb 05, 2026

Feb 05, 2026

Understanding the link between compliance support, credit assessment, and MSME loan interest rates after Budget 2026

Authored by FlexiLoans | Date: 05/02/2026

- Quick Summary

- What: Corporate Mitras, introduced as part of Budget 2026 reforms, aim to support MSMEs with compliance, documentation, and formalisation, directly influencing loan eligibility and interest rates.

- Why: Better compliance improves credit profiles, reduces perceived lender risk, and can lead to more favourable MSME loan interest rates.

- Who: MSMEs, self-employed professionals, and small enterprises seeking business loans at competitive interest rates.

- How: Structured compliance, financial transparency, and timely filings help lenders assess businesses more efficiently and price loans more accurately.

- Use Case: An MSME improves GST and financial compliance with Corporate Mitra support, strengthening its loan profile and securing a business loan at a lower interest rate.

Access to affordable credit remains one of the most critical challenges for MSMEs. While turnover and credit scores matter, lenders increasingly evaluate compliance quality when determining MSME loan interest rates.

The Union Budget 2026 reinforced this approach by introducing Corporate Mitras, a structured compliance support mechanism designed to help MSMEs meet regulatory requirements more efficiently. This initiative highlights a growing reality in MSME lending. Businesses with stronger compliance frameworks are often seen as lower-risk borrowers.

This article explains what Corporate Mitras are, how compliance affects MSME loan interest rates, and why improving compliance can directly influence borrowing costs.

What Are Corporate Mitras Under Budget 2026?

Corporate Mitras are introduced as part of the Budget 2026 framework to support MSMEs with regulatory compliance, filings, and formalisation processes. The objective is to simplify interactions between businesses and government systems while improving the overall compliance environment.

Corporate Mitras are expected to assist MSMEs with:

- Statutory filings and registrations.

- Financial documentation and record-keeping.

- Compliance awareness and procedural clarity.

- Reducing errors and delays in regulatory processes.

Why Compliance Matters in MSME Lending

From a lender’s perspective, compliance is a proxy for business discipline and financial transparency. Proper filings and records help lenders:

- Validate income consistency.

- Assess business stability.

- Reduce documentation gaps.

- Shorten approval timelines.

Non-compliance or inconsistent filings often increase perceived risk, which can result in higher interest rates or loan rejections.

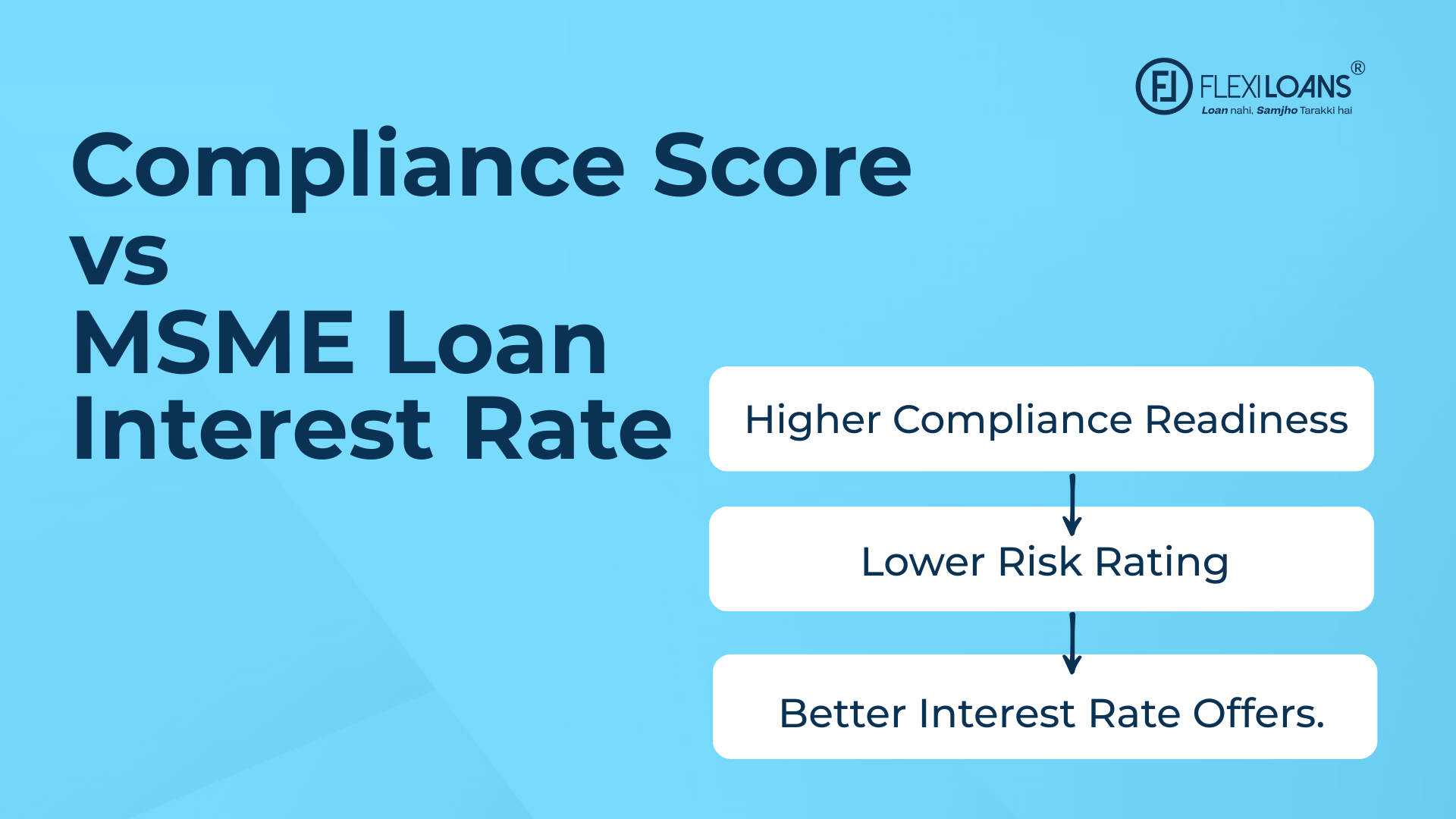

How Compliance Impacts MSME Loan Interest Rates

MSME loan interest rates are influenced by risk assessment. Compliance directly affects this assessment in multiple ways:

- Accurate financial statements enable better cash flow analysis.

- Timely GST and statutory filings improve revenue visibility.

- Clear documentation reduces underwriting uncertainty.

When lenders face lower uncertainty, they can price loans more competitively. Businesses with organised compliance records are often able to access loans at more favourable rates than peers with similar turnover but weaker compliance.

Key Compliance Areas That Influence Loan Pricing

| Compliance Area | Why It Matters to Lenders |

| GST Filings | Reflects revenue consistency and tax discipline |

| Bank Statements | Shows real cash flow and transaction behaviour |

| Business Registration | Confirms legal status and operational legitimacy |

| Financial Statements | Enables accurate profitability assessment |

| Statutory Filings | Reduces legal and regulatory risk perception |

This structured compliance data enables lenders to assess MSMEs with greater confidence.

Corporate Mitras vs Traditional Compliance Support

Traditional compliance support is often fragmented, reactive, and dependent on individual advisors. Corporate Mitras aim to provide more structured and accessible compliance assistance, particularly for smaller businesses that lack in-house expertise.

The key difference lies in proactive compliance management rather than corrective action after lapses occur.

How Better Compliance Improves Loan Eligibility

Improved compliance helps MSMEs by:

- Increasing approval likelihood.

- Reducing documentation queries.

- Supporting higher loan eligibility.

- Improving lender confidence.

For MSMEs planning to apply for business loans, compliance readiness is no longer optional. It is a core component of credit evaluation.

Why Digital Lenders Value Compliance Readiness

Digital lenders rely on data-driven credit assessment. Clean compliance records allow:

- Faster digital verification.

- Reduced manual intervention.

- Quicker credit decisions.

Lending Platforms such as FlexiLoans evaluate multiple financial indicators alongside compliance data to offer MSME loans with transparent pricing and predictable repayment structures.

Compliance has become a critical factor in MSME credit assessment. Initiatives like Corporate Mitras can help businesses strengthen their documentation and financial discipline, which in turn supports better access to credit and more efficient loan pricing.

Conclusion

Budget 2026 has reinforced the role of compliance in MSME growth and financing. Corporate Mitras are positioned to help MSMEs strengthen their regulatory foundations, improve transparency, and reduce friction in accessing credit.

For businesses seeking MSME loans, better compliance can translate into smoother approvals and more competitive interest rates. As lending becomes increasingly data-driven, compliance readiness will continue to play a central role in determining financing outcomes.

FAQs

Ans: Corporate Mitras are a compliance support initiative announced in Budget 2026 to help MSMEs manage regulatory filings, documentation, and formalisation more effectively.

Ans: Strong compliance reduces lender risk by improving financial transparency, which can lead to more favourable loan interest rates.

Ans: Corporate Mitras do not set interest rates. However, better compliance supported by Corporate Mitras can improve credit assessment outcomes.

Ans: While not mandatory, MSMEs with organised compliance records generally experience faster approvals and better loan terms.

Ans: Digital lenders rely on data accuracy. Clean compliance records enable faster digital verification and smoother loan processing.

Glossary: Key terms explained

| Term | Definition |

| Corporate Mitras | A Budget 2026 initiative designed to support MSMEs by simplifying regulatory compliance, documentation, and access to government-backed financial services. |

| MSME Loan | A business loan specifically offered to Micro, Small, and Medium Enterprises to support working capital needs, expansion, equipment purchase, or operational expenses. |

| MSME Loan Interest Rate | The percentage charged by lenders on MSME loans reflects the cost of borrowing and is influenced by factors such as credit profile, risk level, and loan tenure. |

| Compliance | The process of adhering to all applicable statutory, regulatory, and legal requirements governing business operations, taxation, and financial reporting. |

| GST Filing | The submission of periodic tax returns under the Goods and Services Tax system, detailing sales, purchases, tax collected, and tax paid by a business. |

| Credit Assessment | The evaluation of a borrower’s financial health, credit history, cash flows, and repayment capacity to determine loan eligibility and risk. |

| Digital Lender | A financial institution or platform that offers lending services primarily through online and technology-driven channels, enabling faster loan processing and approvals. |

| Risk Profiling | The analysis of a borrower’s likelihood of default based on financial behavior, business stability, industry risk, and past credit performance. |

| Financial Transparency | The practice of maintaining clear, accurate, and verifiable financial records enables lenders and regulators to assess a business’s true financial position. |

| Loan Eligibility | A set of criteria, such as business age, revenue, credit score, and compliance status, that determines whether a borrower qualifies for a loan. |

| Documentation | Financial, legal, and operational records required for loan evaluation, including bank statements, tax returns, registration certificates, and financial statements. |

| Cash Flow | The movement of money into and out of a business over a specific period, indicates its ability to meet short-term obligations and sustain operations. |

| Business Registration | The legal process of formally establishing a business entity with the appropriate government authority, granting it official recognition. |

| Underwriting | The lender’s internal process of reviewing and validating a loan application to assess risk, determine eligibility, and finalize loan terms. |

| Loan Pricing | The determination of loan interest rates and charges is based on the borrower’s risk profile, creditworthiness, loan amount, and market conditions. |

Is this information helpful?