Feb 09, 2026

Feb 17, 2026

How small business owners and self-employed professionals can leverage their bank statements to secure quick financing.

Authored by FlexiLoans | Date: 09/02/2026

Running a small business or being self-employed often comes with unpredictable income streams. Traditional business loans typically require collateral, tax filings, and lengthy approvals, which can be challenging for individuals without extensive financial documents.

Bank statement-based loans address this by allowing lenders to assess real cash flow rather than relying solely on collateral or formal financial statements. In 2026, platforms like FlexiLoans provide these loans digitally, ensuring faster approvals and flexible repayment terms.

This guide walks you through everything you need to know about business loans based on bank statements, including eligibility, required documents, benefits, application steps, and practical tips for approval.

What Is a Business Loan Based on Bank Statement?

A bank statement-based loan is a type of business or personal financing in which lenders evaluate your recent account statements to assess income, cash flow, and repayment capacity.

- No Collateral Needed: Many of these loans are unsecured, meaning you don’t have to pledge property or business assets.

- Quick Approval: Since lenders rely on verified account activity, processing is faster.

- Flexible Loan Amount: The loan limit is often based on average monthly turnover and transaction patterns.

Why These Loans Are Ideal for Self-Employed and MSMEs

Self-employed professionals and MSMEs often face challenges in proving income or financial stability through conventional documents. Bank statement-based loans are beneficial because:

- Cash Flow Driven: Approval is based on actual inflows and outflows rather than tax returns.

- Minimal Paperwork: Only bank statements and basic KYC documents are needed.

- Fast Disbursal: Lenders like FlexiLoans can transfer funds within 48–72 hours.

- Flexible Use: Funds can be used for operational needs, equipment, or growth initiatives.

- Inclusive Financing: Enables businesses with irregular income patterns to access capital.

How to Assess Your Loan Eligibility Using Bank Statements

Before applying, ensure your account demonstrates consistent cash flow and turnover:

- Review Your Account Activity: Lenders typically consider 6–12 months of statements. Consistent deposits strengthen approval chances.

- Calculate Average Monthly Turnover: Helps estimate the potential loan amount lenders may offer.

- Check for Major Outflows: Large irregular withdrawals may reduce the eligible loan amount.

- Maintain a Healthy Balance: Avoid low balances or negative balances before applying.

- Ensure Account Authenticity: Loan approval depends on verifiable and legitimate bank transactions.

Tip: Using statements from a business or current account improves credibility compared to personal accounts.

What are the Common Uses of Bank Statement-Based Loans?

Funds obtained from these loans can support multiple business needs:

- Working Capital: Manage salaries, vendor payments, and day-to-day expenses.

- Business Expansion: Open new branches, hire staff, or expand services.

- Equipment Purchase: Buy machinery, computers, or office infrastructure.

- Marketing & Branding: Promote products/services to grow revenue.

- Emergency Funding: Address unforeseen operational or business expenses.

These loans provide flexible capital access without the constraints of collateral.

Interest Rates and Costs to Expect in 2026

Interest rates vary depending on the lender and applicant profile:

| Lender Type | Typical Interest Rate (p.a.) | Notes |

| Public Banks | 12% – 16% | Self-employed businesses with strong transaction history. |

| Private Banks | 14% – 20% | MSMEs and small businesses with verified bank statements. |

| NBFCs & Fintechs | 15% – 24% | Collateral-free loans with quick digital approval. |

FlexiLoans offers competitive rates starting from 1% per month, based on turnover, cash flow, and business performance.

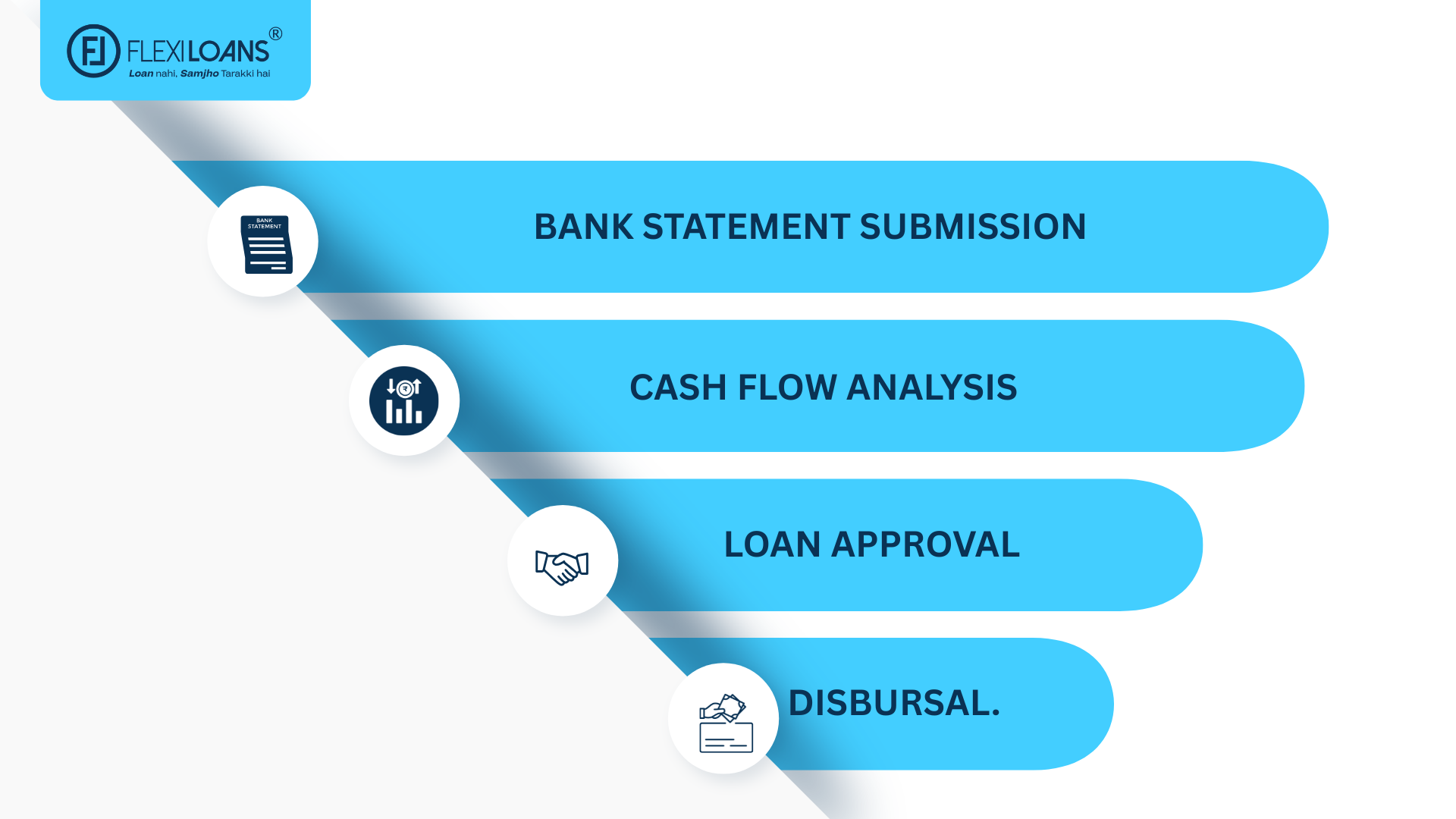

Step-by-Step Application Process

Applying for a bank statement-based loan is simple if you follow these steps:

- Step 1: Evaluate Your Need: Determine whether the funds are for working capital, expansion, or equipment purchase.

- Step 2: Gather Bank Statements: Collect 6–12 months of statements for review.

- Step 3: Verify KYC Documents: PAN, Aadhaar, and other identity proofs are required.

- Step 4: Choose Your Lender: Compare interest rates, repayment options, and loan limits.

- Step 5: Apply Online: Submit statements and documents via FlexiLoans’ digital portal.

- Step 6: Loan Disbursal: Funds are transferred to your account once the loan is approved.

- Step 7: Manage Repayment: Align EMIs with your cash flow for smooth repayment.

Why FlexiLoans Is the Go-To Lender for Bank Statement Loans

FlexiLoans is preferred for these loans because:

- Fast Digital Processing: Quick submission and verification of bank statements.

- Collateral-Free Options: Many loans require no security, especially for smaller amounts.

- Transparent Terms: Clear interest, fees, and repayment schedules.

- Flexible Loan Amounts: Tailored to your turnover and cash flow.

- Dedicated Support: Step-by-step guidance for faster approval and disbursal.

What are the Practical Tips to Maximize Approval Chances?

- Ensure Consistent Cash Flow: Avoid irregular deposits or withdrawals before application.

- Use a Business or Current Account: Lenders prefer verified business transactions.

- Maintain Updated KYC: PAN, Aadhaar, and other documents should be up to date.

- Apply Within Limits: Request a loan based on average turnover to increase chances.

- Plan EMIs Strategically: Aligning repayment schedules with revenue cycles reduces default risk.

Final Thoughts

Bank statement-based loans offer self-employed professionals and MSMEs a fast, flexible, and collateral-free financing option. With FlexiLoans, businesses can leverage their verified bank transactions to access funding within days, enabling smooth operations, business growth, and strategic investments.

FAQs: Bank Statement–Based Business Loans

Ans: A business loan based on a bank statement is a financing option where lenders assess your recent bank account activity, such as deposits, withdrawals, and average balance, to evaluate income stability and repayment capacity. Instead of relying heavily on collateral or detailed financial statements, lenders use real cash flow data to determine eligibility and the loan amount.

Ans: Self-employed professionals, small business owners, freelancers, and MSMEs with consistent banking activity are eligible to apply. Applicants typically need 6–12 months of bank statements showing regular inflows. Even businesses with limited formal documentation may qualify if their cash flow is stable.

Ans: Most lenders require bank statements for the last 6 to 12 months. A longer statement history with consistent transactions improves approval chances and may help secure a higher loan amount or better terms.

Ans: Yes, many bank statement-based loans are unsecured, meaning no property or asset needs to be pledged. However, for higher loan amounts, some lenders may request additional assurance, such as a co-applicant or partial security.

Ans: The loan amount is usually determined by average monthly turnover, frequency of deposits, cash-flow consistency, and account balance trends. Businesses with steady inflows and low volatility generally receive higher eligibility limits.

Ans: With digital lenders like FlexiLoans, approval and disbursal can happen within 48–72 hours after submission and verification of bank statements and KYC documents, making it ideal for urgent funding needs.

Ans: Yes, personal bank accounts are accepted, especially for freelancers or sole proprietors. However, a business or current account with clear transaction records is preferred, as it improves credibility and approval chances.

Glossary: Key Terms Explained

| Term | Definition |

| Bank Statement-Based Loan | A loan is approved primarily by analysing bank account transactions to assess income, cash flow, and repayment ability. |

| Business Loan | Financial assistance is provided to businesses for operational expenses, expansion, or working capital requirements. |

| Self-Employed Professional | An individual who earns income independently through business, trade, or professional services. |

| Collateral-Free Loan | A loan that does not require the borrower to pledge assets such as property, machinery, or inventory. |

| Cash Flow | The movement of money into and out of a business indicates its ability to meet financial obligations. |

| Turnover | The total revenue generated by a business over a specific period is often used to assess loan eligibility. |

| EMI (Equated Monthly Installment) | A fixed monthly payment comprising principal and interest is used to repay a loan over time. |

| Loan Tenure | The total duration over which the borrower must repay the loan amount. |

| Disbursal | The transfer of the approved loan amount from the lender to the borrower’s bank account. |

| KYC (Know Your Customer) | A mandatory verification process to confirm the identity and authenticity of borrowers. |

| PAN | A Permanent Account Number is used for tax filing and financial identification in India. |

| Aadhaar | A government-issued unique identification number used for identity verification. |

| Current Account | A bank account used primarily for business transactions with higher transaction limits. |

| Average Monthly Balance | The average amount maintained in a bank account over a month indicates financial stability. |

| Digital Lender | A technology-driven financial institution offering online loan applications, approvals, and disbursals. |

Is this information helpful?