Feb 03, 2026

Feb 05, 2026

What retailers should understand about collateral-free business loans after Budget 2026

Authored by FlexiLoans | Date: 03/02/2026

- Quick Summary

- What: Budget 2026 strengthened credit guarantee frameworks that support collateral-free MSME loans, indirectly expanding effective lending limits.

- Why: Retail businesses often face challenges securing finance without pledging assets, especially for working capital and growth needs.

- Who: Retailers, shop owners, small traders, and MSME entrepreneurs seeking business loans without collateral.

- How: Enhanced credit guarantee coverage, specialised products, and digital lending platforms help improve access to collateral-free business loans.

- Use Case: A retail store uses credit guarantee-backed lending to access a collateral-free working capital loan, enabling stock purchase ahead of a festive season without risking property or equipment.

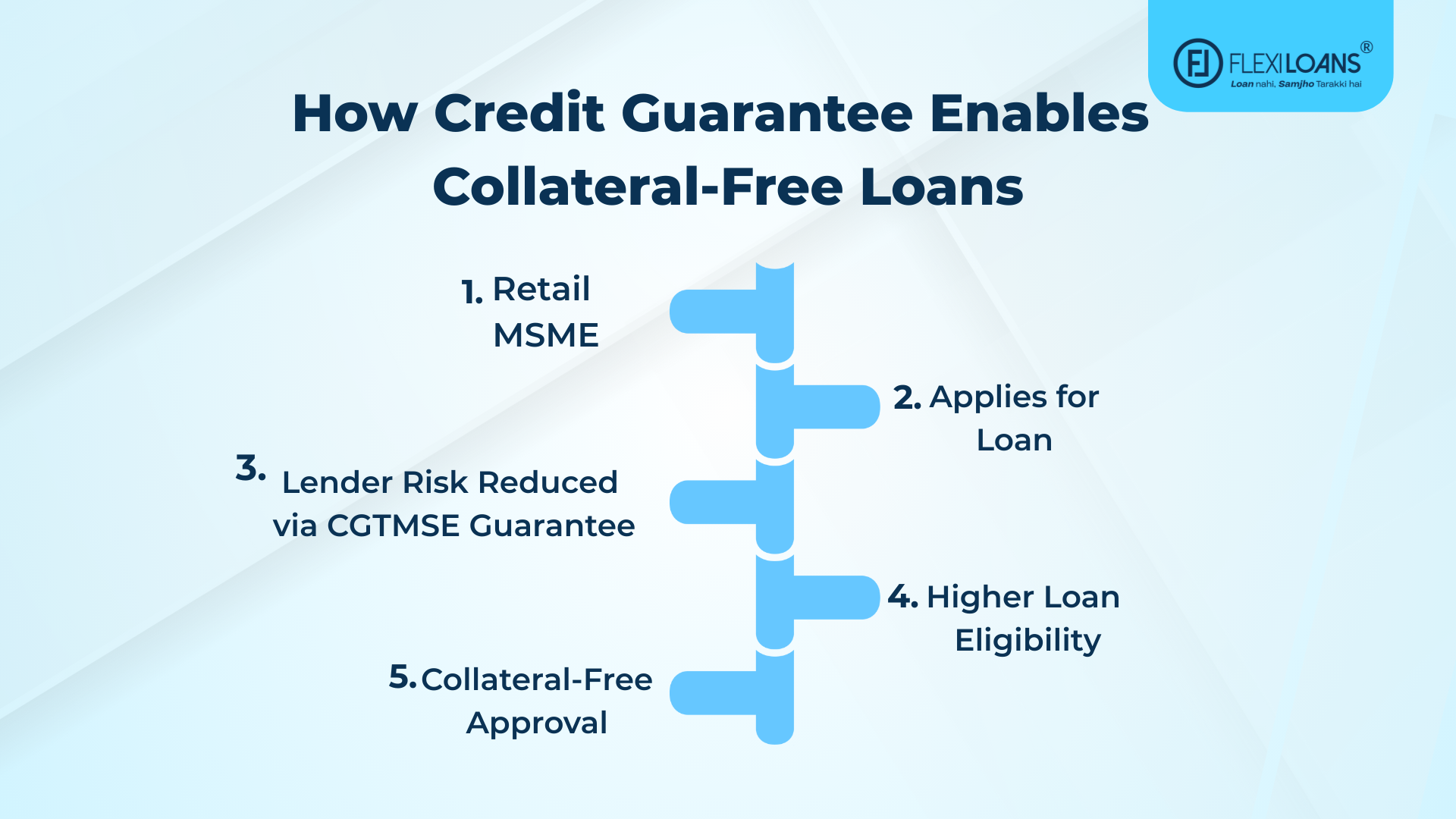

Retail businesses depend heavily on working capital to manage inventory, sales cycles, staffing, and expansion. Traditionally, lenders offered unsecured loans only in limited amounts or at high interest rates due to perceived risk. That changed with the government’s long-term support mechanisms, such as the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), which encourages banks and NBFCs to issue collateral-free loans by sharing risk.

The Union Budget 2026 continued this focus by reinforcing credit guarantee schemes and expanding coverage in key sectors. For retailers and MSMEs, this means better access to collateral-free business loans, which can be crucial for growth and cash-flow stability.

Let’s explain how collateral-free MSME loans work post-Budget 2026, typical limits, eligibility, and documentation.

What Are Collateral-Free Business Loans?

A collateral-free business loan is financing that does not require the borrower to pledge physical assets such as land, property, machinery, or equipment as security. Instead, eligibility is determined by credit profile, turnover, business performance, and repayment history.

These loans often benefit from credit guarantee schemes backed by government entities, which cover a significant portion of the risk. This encourages banks and NBFCs to offer unsecured credit to viable businesses.

How Budget 2026 Affects MSME Collateral-Free Lending

Although Budget 2026 did not set a fixed maximum loan quantum for all collateral-free lending, it reinforced and expanded credit guarantee schemes that indirectly widen effective lending capacity for unsecured business loans.

Key points include:

- Expansion of credit guarantee cover under CGTMSE and related schemes helps banks and NBFCs lend more while sharing risk.

- Guarantees for term and working capital loans have been enhanced, and fees rationalised for certain focus sectors.

- Tailored credit products, such as micro-enterprise credit cards, continue to offer easy credit up to specified limits.

Collectively, these changes enable lenders to offer larger unsecured loans than might otherwise be feasible.

Typical Collateral-Free Loan Limits for Retail Businesses

While there is no single statutory cap on collateral-free MSME loans prescribed in Budget 2026, existing government-linked schemes provide indicative ceilings:

- CGTMSE-backed loans: Traditionally cover up to ₹5 crore of credit exposure for micro and small enterprises, with the guarantee covering a significant portion of lender risk. Enhanced guarantee provisions (including focus sectors) support higher effective loan amounts.

- Micro-enterprise credit cards often extend credit lines of ₹5 lakh to ₹10 lakh for routine business needs.

- Export-linked working capital support: In some cases, exporters (including retail exporters) can access collateral-free working capital up to around ₹10 crore under special guarantee schemes.

For retail businesses with solid business performance and documentation, digital lenders may also offer unsecured working capital or business loans beyond these indicative figures, depending on risk profile and credit assessment.

Eligibility for Collateral-Free MSME Loans

Retail businesses generally need to meet criteria such as:

- Minimum business vintage (often 1–2 years or more).

- Consistent monthly or annual turnover.

- Satisfactory credit history and credit score.

- Valid business registration and GST compliance.

Participation in government schemes like Udyam registration strengthens eligibility and access. Digital lenders also assess business bank inflows and operational stability.

Required Documents for Retail Business Loan Applications

Most lenders (banks or NBFCs) require:

- PAN and Aadhaar of the proprietor/partners.

- Business registration proof (GST, Udyam, etc.).

- Bank statements (typically last 6–12 months).

- Profit and loss statements or basic financial summaries.

- Additional documents as requested based on the loan amount and risk profile.

Proper documentation reduces processing time and improves the chances of approval.

Comparing Collateral-Free Loans and Secured Loans

| Feature | Collateral-Free Loan | Secured Loan |

| Asset security | Not required | Required |

| Approval speed | Faster with digital lenders | Slower due to valuation |

| Risk for the lender | Mitigated via a guarantee | Secured by asset |

| Ideal for | Working capital, stock purchase | Large capex or long-term assets |

| Interest rates | Slightly higher than secured | Generally lower |

Collateral-free loans are designed for short-term operational needs without risking business assets.

When Retailers Should Consider Collateral-Free Loans?

Retail businesses may prefer collateral-free loans when:

- They need timely working capital for inventory or seasonal demand.

- They are avoiding asset pledging due to valuation risk.

- They want flexibility for day-to-day business needs.

Collateral-free loans help maintain liquidity without tying up property or equipment as security.

Collateral-free business loans, supported by enhanced credit guarantee coverage, offer retailers a practical way to manage cash flow and operational needs. Post-Budget 2026 reforms strengthen this ecosystem, encouraging lenders to expand unsecured credit where the risk profile supports it.

Final Thoughts

Budget 2026 reinforces the government’s commitment to expanding credit access for MSMEs. While there is no single new statutory “loan limit” for collateral-free MSME loans, enhanced guarantee structures and supportive schemes widen practical access to unsecured business financing for retailers.

Retailers seeking flexible working capital or business loans should explore collateral-free options supported by guarantee schemes, while maintaining strong compliance and financial documentation.

FAQs

Ans: A collateral-free business loan is financing that does not require pledging property or other assets as security. Eligibility is based on business performance, credit history, and financial documentation.

Ans: Budget 2026 does not prescribe specific numeric limits for collateral-free loans. However, expanded credit guarantee coverage under schemes such as CGTMSE effectively supports greater unsecured lending capacity.

Ans: Retailers can enhance their eligibility by registering under MSME schemes, maintaining consistent turnover, filing GST returns regularly, and maintaining clean bank statements.

Ans: Interest rates on collateral-free loans are typically slightly higher due to the absence of pledged assets, though credit guarantee schemes help reduce lender risk and cost.

Ans: Yes. Based on strong financials and credit assessment, digital lenders may offer larger unsecured loans than traditional indicative ceilings.

Glossary: key terms explained

| Term | Definition |

| Collateral-Free Loan | A loan provided without requiring the borrower to pledge property or other assets as security. |

| MSME | Micro, Small, and Medium Enterprise classified based on investment and turnover criteria in India. |

| Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) | A government-backed trust that provides credit guarantee cover to lenders for collateral-free loans to MSMEs. |

| Working Capital | Funds used to manage day-to-day business operations such as inventory, payroll, and vendor payments. |

| Digital Lender | A financial institution that processes loans online using automated and data-driven systems. |

| Udyam Registration | Official registration for MSMEs in India, enabling access to various government credit schemes. |

| Bank Statement | A record of all transactions in a business bank account over a specified period. |

| Credit Score | A numerical representation of an individual’s or a business’s creditworthiness. |

| Secured Loan | A loan backed by pledged assets such as property or equipment. |

| Interest Rate | The cost a lender charges for borrowing funds, expressed as a percentage. |

| Profit and Loss Statement | A financial document showing revenue, costs, and profit over a specific period. |

| Liquidity | The ability of a business to meet short-term financial obligations with available cash. |

| Operational Expenses | Regular day-to-day business costs such as rent, salaries, and utilities. |

| Loan Disbursal | The process by which approved loan funds are transferred to the borrower’s account. |

| Credit Assessment | Evaluation of a borrower’s creditworthiness based on financial and credit history. |

Is this information helpful?