Home > Cancelled Cheques

Cancelled Cheque Explained - Meaning, Uses, and Format

Learn how cancelled cheques work, their format, and why they’re used for account verification, ECS, and loan documentation.

Authored By FlexiLoans | Date:06/09/2025

- Quick Summary

- What: A cheque marked “CANCELLED” to prevent future use

- Why: Verifies bank details and authorises auto payments

- Who: Required by individuals, employees, tenants, or loan applicants

- How: Draw lines across the cheque and write "CANCELLED" in bold across it

- Use Case: Required for KYC, ECS, EMI setup, and online loan application

Introduction

If you have ever wondered what cancelled cheques are and how they affect your day-to-day life affairs, you have come to the right place.

In the age of digital payments and online transactions, cheques may seem like a relic of the past. However, cancelled cheques continue to hold significance in providing a tangible record of payments.

Whether you are a business owner, a tenant, or an individual seeking financial assistance, understanding the basics of cancelled cheques is essential for navigating various aspects of everyday life.

Cancelled cheques are not just mundane pieces of paper but rather powerful financial tools that can significantly impact your loan applications. By understanding their basics and relevance in everyday life, you can unlock opportunities to secure the loan you need.

Traditional methods to secure a loan are great but they require a strong credit history. Try FlexiLoans which provides loans and loan-related services to small and medium-sized enterprises/businesses (SMEs) through its online platform.

What is a Cancelled Cheque?

In simple words, a cancelled cheque is a cheque that has been marked as cancelled to prevent its further use for financial transactions. A cancelled cheque means that the payment has been made or the funds transferred electronically. The cancellation process typically involves marking the cheque with the word "CANCELLED". This makes the cheque unusable.

Cancelled cheques serve various purposes such as:

- proof of payment

- verification of bank account details

- authorisation for automatic payments.

A cancelled cheque is a financial instrument that has been rendered invalid for future transactions, ensuring security, accountability, and clarity in financial dealings. They help maintain accurate financial records and can act as evidence in legal matters. Cancelled cheques also prevent fraud, as you cannot use them to withdraw funds once cancelled.

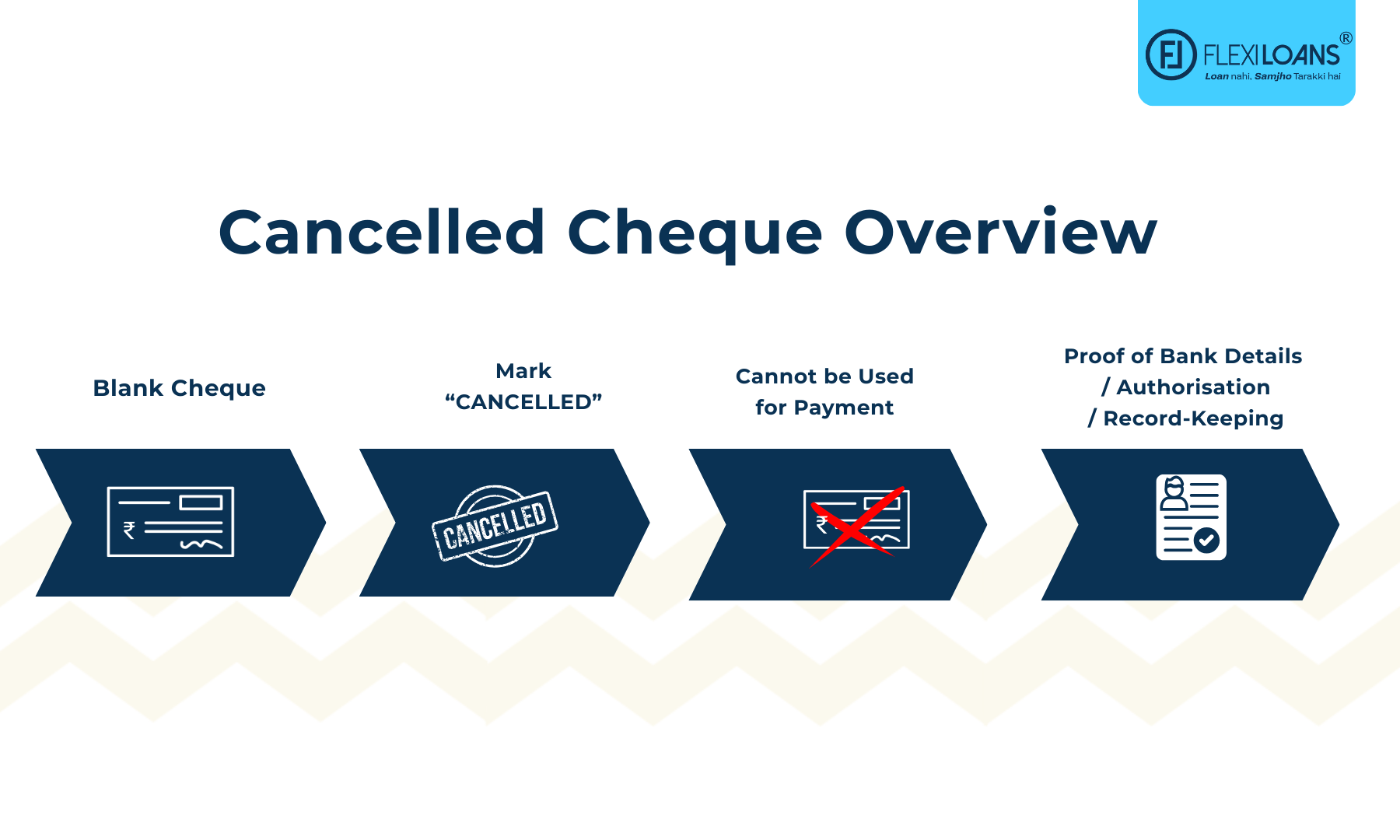

Cancelled Cheque Overview

Sample Cancelled Cheque

Here's a cancelled cheque image for reference so you get an idea of how to cancel a cheque:

In this example of cancelled cheque photo, the cheque has the necessary details including the following:

- Payer's name and address line date: This section displays the name and address of the individual or entity who is issuing the cheque.

- Date: The date field on the cheque indicates the date of issue for the cheque is issued or the date when the payer signs.

- Amount Line: The amount line is where the written amount of money for transfer is indicated in words.

- Cheque Number: The cheque number is a unique identification number assigned to each cheque.

- Bank Fraction: The bank fraction provides information about the bank and branch associated with the cheque.

- Amount Box: The amount box contains the numerical value of the payment amount.

- Payer Signature Line: The payer's signature line is where the account holder's signature is required to authorise the transaction.

- Checking Account Number: This field contains the account number associated with the payer's checking account.

- Bank Routing Number: The bank routing number is a series of digits that identifies the bank or financial institution where the payer's account is held.

- Memo Line: The memo line provides space for adding additional information or instructions related to the purpose of the payment.

Please note that the image provided is for illustrative purposes only. It's important to safeguard your personal and financial information and avoid sharing sensitive details publicly.

Use of Cancelled Cheque

Cancelled cheques have several practical applications in everyday life that include:

Proof of Payment

Cancelled cheques act as proof that a payment has been made to a specific recipient.

When you write a cheque to someone, once they deposit it and the payment processes, the cheque is marked as cancelled by the processing bank/financial institution. This indicates that the payment has been completed.

By keeping a record of cancelled cheques, you can easily provide evidence of payment if any disputes or discrepancies arise in the future.

For instance, if you have made a payment for rent or service, the cancelled cheque acts as concrete proof that you have fulfilled your financial obligations. This can help you avoid any misunderstandings or conflicts regarding payments.

Bank Account Verification

Cancelled chequesare commonly used to verify bank account details. When you provide a cancelled cheque, it allows the recipient or a financial institution to confirm the accuracy of your bank account information, including your account number and the name of the account holder.

This verification process is particularly important when setting up direct deposits, electronic fund transfers, or automatic bill payments.

By presenting a cancelled cheque, you provide tangible evidence of your bank account details. This helps ensure that the funds are accurately directed to the intended account. Financial institutions and service providers may request a cancelled cheque to verify your bank account information to safeguard against errors or potential fraud.

A table showcasing the bank account verification process using cancelled cheques is as below:

| Steps | Bank Account Verification with Cancelled Cheques |

| Step 1: Collect | Collect a cancelled cheque associated with your bank account. |

| Step 2: Submit | Submit the cancelled cheque as proof of your bank account details. |

| Step 3: Validation | The bank verifies the account details using the cancelled cheque. |

| Step 4: Confirmation | Once verified, the bank confirms the accuracy of your bank account details. |

Authorisation for Automatic Payments

You can use cancelled cheques to authorise automatic payments from your bank account. When you set up automatic payments, such as recurring bills or subscriptions, you typically need to provide a cancelled cheque as proof of authorisation. This allows the service provider to debit the specified amount from your account on a predetermined schedule.

By providing a cancelled cheque, you grant permission to the service provider to deduct payments directly from your bank account. This simplifies your financial management by eliminating the need for manual payments each time and helps ensure timely payments without the risk of forgetting or missing due dates.

Fraud Prevention

Cancelled cheques play a crucial role in fraud prevention. A cancelled cheque is invalid and cannot finance any transactions. This prevents unauthorised individuals from altering the cheque or attempting to withdraw funds from your account using the cancelled cheque.

By promptly cancelling your cheques after the payment has been made, you add an extra layer of security to your financial transactions. Even if someone gains access to your cancelled cheque, they cannot utilise it to withdraw funds or make unauthorised payments. This protects you from potential fraud and safeguards your financial interests.

Statistics from the National Fraud Prevention Association highlight the effectiveness of cancelled cheques in reducing financial fraud:

- Cancelled cheques helped prevent 86% of cases involving forged cheques.

- 92% of businesses reported a decrease in cheque-related fraud incidents after implementing cancelled cheques.

Financial Record-Keeping

Cancelled cheques are essential for maintaining accurate financial records. By retaining cancelled cheques, you have tangible evidence of your payment history and financial transactions. This documentation can be valuable for personal or business purposes, allowing you to track and reconcile your financial activities.

Cancelled cheques serve as a reference point when reviewing your bank statements or when conducting audits. They provide a detailed record of payments made, along with the associated dates, payees, and amounts. This can be particularly useful for tax purposes, expense tracking, or verifying payment history during financial assessments.

By organising and retaining cancelled cheques, you ensure a comprehensive and reliable financial record-keeping system, promoting transparency and facilitating efficient financial management.

A cancelled cheque might look simple, but it’s a vital tool for ensuring security and authenticity in today’s digital-first financial systems.

How to Write Cancelled Cheque:

Writing a cancelled cheque is a simple process that involves marking the cheque to show that it is no longer valid for financial transactions. Here is a step-by-step guide to help you write a cancelled cheque:

Step 1: Gather the necessary materials:

Start by collecting a blank cheque from your chequebook. Ensure that you have a pen or marker readily available.

Step 2: Fill out the necessary details:

Write the date on the appropriate line provided on the cheque. This helps indicate when the cheque was cancelled.

Fill in the payee's name on the "Pay to the Order of" line. You can use your name or write "Cancelled" to indicate that the cheque is no longer valid for payment.

Add the amount in the designated box or line. You can write "Cancelled" or draw a line through this section to show that the amount is irrelevant.

Step 3: Mark the cheque as cancelled:

Using a pen or marker, write the word "CANCELLED" across the face of the cheque. Make sure the writing is clear and legible.

Alternatively, you can pierce the cheque by punching small holes or stamping it with a cancellation stamp.

Step 4: Sign the cheque:

Sign the cheque in the space provided for the signature. This finalises the cancellation process.

Step 5: Retain the cancelled cheque for your records:

It's important to keep a record of the cancelled cheque for your reference. You can file it along with your other financial documents or statements.

By following these simple steps, you can easily write a cancelled cheque. Remember, the purpose of a cancelled cheque is to indicate that it is no longer valid for financial transactions. Whether you mark it with the word "CANCELLED" or use a cancellation stamp, the goal is to render the cheque unusable while maintaining a record of the cancelled transaction.

FlexiLoans makes the rest easy. Get collateral-free business loans up to ₹50 lakhs with a 100% digital application, minimal paperwork, and flexible repayment options.

Learn More

In Summary:

Cancelled cheques are a great way to keep track of your financial transactions and also avoid fraud. By providing a cancelled check, you can also authorise automated payments like mobile recharges, or OTT subscriptions from your bank account. The holder of the cheque can't use it to make transactions but only to verify your bank details, ensuring complete safety and security.

If it is security and transparency are what you are looking for, we make them priorities here at FlexiLoans. From strictly using RBI-mandated guidelines to providing business loans you can track the status every step of the way, we believe safety comes first. Apply now for an unsecured business loan from FlexiLoans and take advantage of features like flexible repayment and quick processing rates.

If you are facing challenges in obtaining traditional bank loans due to limited credit history, try FlexiLoans which provides loans and loan-related services to small and medium-sized enterprises/businesses (SMEs) through its online platform.

Frequently asked questions

| Term | Meaning |

| Cancelled Cheque | A cheque with the word "CANCELLED" written across it, used for verification, not transactions. |

| Cheque Number | A unique number printed on every cheque, used for tracking. |

| Bank Routing Number | A numeric code that identifies your bank and branch. |

| MICR Code | Magnetic Ink Character Recognition code used for fast cheque processing. |

| Account Number | The unique number assigned to your bank account. |

| Authorisation | Consent given to a bank or service provider to debit your account. |

| Verification | The process of confirming account details using documents like a cheque. |

| Direct Deposit | Automatic transfer of funds into a recipient's bank account. |

| Fraud Prevention | Steps taken to prevent unauthorised access or misuse of financial details. |

| Bank Statement | A summary of financial transactions in your account over a set period. |

Recent Posts

- How to Check Bank Balance Online Without Going to the Bank

- Learn How to Earn Money Online Without Investment for Students

- 10 Reasons Why You Should Take An Equipment Loan

- Business Loan Requirements: 7 Things You’ll Need To Qualify

- Best Small-Business Loans Of 2023

- The Benefits of Building a Relationship with Your Business Lender

- The Importance of a Solid Business Plan for Loan Applications

- Top 31 Small Business Ideas with Low Investment and High Profit

- Apply for MSME/PSB Loans in 59 Minutes – All You Need to Know

- View More

Business loan

Business Loan Type

- MSME Loan

- Small Business Loan

- Business Loan for Women

- SME Loan

- Term Loan

- Supply Chain Finance

- GST Business Loan

- Wholesale Business Loan

- Short Term Business Loan

- Self Employed Business loan

- Unsecured Business Loan

- Collateral Free Business Loan

- Corporate Loans

- Instant Loan on Aadhar Card

- Working Capital Loan

- View More

Business Loan by Industry

- e-Commerce Business Loan

- Retail Business Loan

- Sole Proprietor Business loan

- Mudra Loan Interest Rate

- Myntra Seller Business Loan

- Amazon Seller Business Loan

- Flipkart Seller Business Loan

- Business Loan for Traders

- Business Loan for Shopkeepers

- Import Finance Business Loan

- Service Sector Business Loan

- Finance for Automobile Business

- Beauty and Personal Care Business Loan

- Footwear Business-Loan

- Fashion Industry Business Loan

- Loan for Accessories Business

- View More

Business Loan by City

- Business Loan in Bihar

- Business Loan in Mumbai

- Business Loan in Kolkata

- Business loan in Delhi NCR

- Business Loan in Pune

- Business Loan in Hyderabad

- Business Loan in Chennai

- Business Loan in Bangalore

- Business Loan in Ahmedabad

- Business Loan in Coimbatore

- Business Loan in Jaipur

- Business Loan in Surat

- View More

Business Ideas

- Best Business Ideas in Tamil Nadu

- Business Ideas to Start in Gujarat

- Business Ideas in Jaipur

- Top Business Ideas in Bangalore

- Business Ideas in Pune

- Business Ideas In Bihar

- Small Business Ideas in Punjab

- Business Ideas in Goa

- Business Ideas in Kolkata

- Small Business Ideas for Rural Areas in India

- Wholesale Business Ideas To Start In India

- 10 Part-Time Business Ideas

- 31 Small Business Ideas with Low Investment and High Profit

- Business Ideas for Women

- View More

Trending Articles

- Advantages and Disadvantages of Goods and Services Tax in India

- Difference Between Flat Interest rate vs. Reducing Interest rate

- Importance of Working Capital Management

- How to Start a Pharmacy Business in India?

- MSME Registration Process

- Business License in India

- How to Check Your Small Business Loan Status

- MSME Registration Benefits in India

- A List Of Businesses That Come Under MSME

- PMEGP Scheme List

- How to Change Name and Address on PAN Card

- Udyam Aadhar Registration Online

- Schemes and FAQs Related to Jan Samarth Portal

- Documents Required For Pan Card

- GST Late Fee Interest Calculator

- How to Write a Cancelled Cheque?

- Poultry Farm Business Plan

- View More