FINANCIAL MANAGEMENT TIPS FOR EVERY SMALL BUSINESS OWNER

Jul 24, 2019

Having a passion to become a business magnet does not alone take you to that level. Don’t think we are discouraging you. But you need to understand a few basic financial management tips in your day to day business to sustain and succeed in business. We are glad that you see your zeal in becoming an industrialist. As a baby step, you have decided to start a small business. At this stage, we would like to suggest you some basics about managing your finance and help you skyrocket your business.

Let’s get going. Few of you might have a background in finance education and it will be a cakewalk for you to manage funds in an effective way. But others should know these details before marching forward.

One more last cent, we are not going to talk about the usual stuff like pay bills on-time, plan ROI, make savings, etc. We are sure that everyone will know these basic tips. Hence we have decided to make this a guide to help you know about micromanaging finance.

In order to manage finance, you must master a few financial terms and we will begin with that.

BUSINESS FINANCE ORGANIZATION

To organize your finances, you need to understand the terms. Yes, awareness about the most commonly discussed terms in finance like cash flow, expense, revenue, profit, etc must be well differentiated for you to manage funds.

All the terms might look similar but they aren’t.

- Cash flow – Cash flow is the amount that you have in hand after profits that will help you grow your business.

- Expenses – The expense is nothing but the amount you use to spend including paying bills, buying materials, loan disbursement, and tax payment.

- Profit – The amount you have in hand after paying all bills from the revenue generated is called the net profit.

- Revenue – Money you have in hand collected from the customer, or a loan. The amount which is yet to be used for spending for business is called the revenue.

To manage funds you must not only know these terms but should understand the basic documentation work to place these above terms in the appropriate places.

- Cash flow statement – The document which records details that include the revenue and the expense to know how much will be left at the end for reinvesting in the business.

- Balance Sheet – It is this sheet that provides details about the asset, liability, and equity the company has at a given point to estimate the business net worth.

- Income statement – It is also referred to as the profit and loss statement (P&L) which will contain the business revenue, expenses, profit, etc since the inception of the business.

- Revenue estimation – Here you can find the details about the revenue position of your company which will let you do effective budgeting.

With these basics, we would like to suggest you the essential tips to manage your finances for a successful business growth

TOP 5 TIPS TO MANAGE FINANCES EFFECTIVELY

- HIRE BUSINESS ACCOUNTANT

You might not want to spend on employees as your business is small. We agree with you, but you need a few key people who will help you grow your money. One such person will be your business accountant. Yes, accounting skills are required to manage finance. You need to understand the terminology given above to start your business. But in the long run, to effectively manage the funding you need a finance person to help you. Do not choose a very senior or high-end profile. Just hire a person with basic skills but smart enough and committed to travel with you. This one right decision will help you sail through all glitches as you can plan your finances in the right way.

- USE THE RIGHT ACCOUNTING SOFTWARE

Hiring the right resource will certainly guide you in the right path. Still, you need to have some understanding of accounting software. The best software will help the business maintain bookkeeping work in a cost-effective manner. When you hire an accountant, check if that person is aware of using the software. Our suggestions about a few bookkeeping software that will support you in managing the accounts include QuickBooks, FreshBooks, or Xero which offer basic package to start with.

- PAY YOUR TAX

Don’t think you are too small to pay tax. Make sure you file tax every year. This will provide you with clear records and thus you can apply for a business loan. Tax papers are one of the primary documents verified by lenders before offering a loan. You must apply for a PAN number for your business as a first step. We suggest you have a current account and manage finances separately between your personal and business expenses. Fearing GST, do not compromise as it may be good at the beginning but that will affect your business status when your business grows. Managing finance does not mean not following rules. Legal compliance will help you get a loan to expand your business in the future.

MANAGE CREDIT SCORE

Credit records are another key factor to manage finance. Again you will have a better chance to get a business loan when you have a clear credit record. Higher the credit score, the greater is the chance for getting a loan. When your loan application gets approved, then you will have more finances to invest and make a profit. Make sure to pay loan bills on time to have a clean credit score.

CHOOSE BUSINESS LOAN WISELY

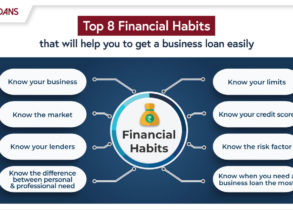

Among all the above-mentioned tips, this one is the most important. Don’t be in a hurry and get trapped while applying for a business loan. Financial management not only lies in understanding your bills, revenue, cash flow, expenses, etc. But know which business loan will suit your business and who the right lender is.

Check the market and RBI guidelines before you apply for a business loan. Financial institutions are the best option for seeking loans as they are rigid as banks; at the same time not scam you as independent lenders do. Collect information including the maximum loan amount, loan interest, fees, and other charges collected by these institutions. Do comparative studies before you apply for a loan. Understand their terms; whether they demand collaterals, their loan processing time, and documentation work. Knowing these details you can decide to choose the right player from the market.

In summary, managing finances does not strictly mean paying bills and handling expenses. But it also depends on how sensibly you work on all areas as mentioned above to keep your business in motion. Follow the tips given above to have a smooth business beginning and move up the ladder at ease.