Is Getting Funds From Invoice Financing Company A Good Idea For Your Business?

Jan 29, 2021

Micro, Small, and Medium Enterprises (MSMEs) play a vital role in boosting the country’s economy. These enterprises face major issues like scarcity of funds, especially the conversion of bill receivables into liquid funds. In collaboration with RBI, resolving such issues, the Government of India introduced the concept of “Invoice Financing.”

MSMEs contribute almost 45% to the annual GDP of the country. Moreover, Invoice financing Company enables such enterprises to experience various benefits like future growth opportunities, asset security, quick process of raising funds for working capital, etc.

But still, lots of business owners doubt whether Invoice Financing is beneficial or not? This article will brief you about the advantages of the Invoice Financing Concept. But, before embarking on the benefits of Invoice Financing, we’ll first have a look at the concept of Invoice Financing and its working mechanism.

What is Invoice Financing?

Invoice Financing is a financial product that serves immediate financing facilities to the large anchor corporate vendors. These vendors use invoices raised against the goods supplied to corporate anchors to avail the working capital funding.

Once the goods are shipped, the invoices will be delivered to the lenders. After receiving the final confirmation from the corporate anchors, the funds will be transferred to the vendor. Although, the funds will be available after deducting the applicable margins.

This financing product eliminates the long credit period between the anchor corporate and vendors by making the payment on behalf of the anchor organization. Early payment to the suppliers offers them an advantage of a short working capital cycle and working capital gaps faced by the supplier while operating business activities.

In layman language, an invoice financing company is a cost-effective financing tool for maintaining day to day business operations smoothly by maximizing the profit levels.

For changing the definition of MSMEs in the country, the government also took the initiative by launching an automated collateral-free loan scheme of INR 3 Lakh crores. The government will also offer subordinated debt of INR 20,000 crore and equity injection of INR 50,000 crores for easy funding to MSMEs.

Working Mechanism Of Invoice Financing Company And Invoice Financing NBFC?

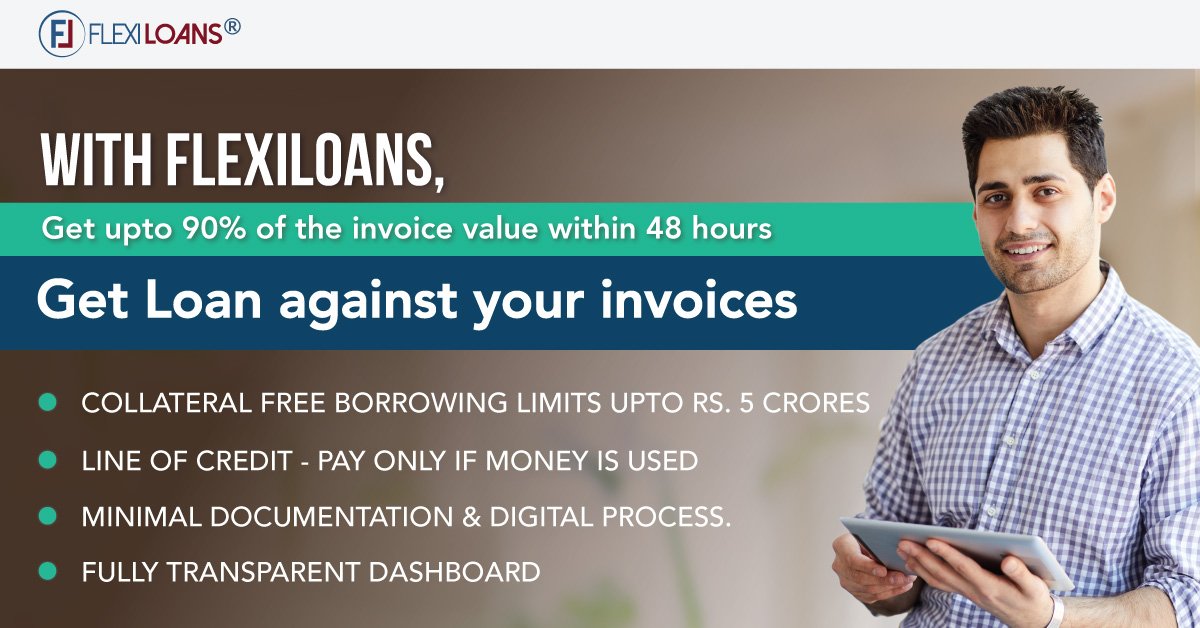

The invoice finance company completes the financing process in two parts. The lender organization provides almost 80% of the invoice value within a single business day from the date of application. Simultaneously, the rest of the 20% amount will be granted after the third party’s payment is cleared. However, the amount granted to the applicant after deducting the processing fees.

Although, the Invoice Financing NBFC somewhat follows a similar path as Invoice Financing Company. Invoice financing NBFC converts the invoice amount into a full or partial business loan. The loan financed by the NBFC will be like a small-ticket or short-term business loan. The loan amount will be payable by the borrower on the due date of the invoice.

Why is Invoice Financing a boon to MSME?

- Unleash your Working Capital and avail Cash Discounts

Invoice financing enacts as the credit line that fulfills the working capital gaps by the vendors. It also facilitates the supplier to receive the payments before due dates against the goods supplied to the corporates.

Moreover, they can utilize these funds to clear all their supplier’s dues before the committed dates. Suppliers can also avail huge cash discounts for early payments.

- Offers Flexibility Unlike CC or OD line

Invoice financing NBFC benefits an organization by offering them flexibility more than that of CC or OD line without any documentation. Credit limit or Overdraft limit considers projected financials or future purchase orders of the vendor for allowing preferred credit flexibility.

On the other hand, the Invoice Financing company offers instant flexibility of credit line by analyzing the past records of sales only.

- Dedicated Relationship Manager

Invoice financing company appoints a dedicated relationship manager for managing all the activities for easy funding of working capital requirements, covering cash payment gaps, managing unexpected revenue expenses, etc.

These managers dedicatedly serve your business to get onboard and smooth out every phase of the transaction journey.

- Lower Risk of Bad Debts and Late Payments

Bad debts and late payments can create a huge working capital gap that can devastate an organization’s base. Undoubtedly, you can take legal actions against such debtors who refuse to settle their accounts late or never. But, it can be a costly and time taking process.

Here an Invoice Financing NBFC can assist your MSME as their experts know the skill to handle such debtors or fund blockers.

Final Verdict

Invoice Financing Company can help your organization in many ways, mainly to tackle the working fund crunch, recovering bad debts, clearing due amounts before the maturity date, etc. So, talk to the Invoice Financing NBFC or Invoice Financing Company experts for guiding you about the whole process for getting the desired output.