Dec 24, 2025

Jan 09, 2026

A complete guide to how medical practitioners can access MSME loans for clinic upgrades, equipment purchase, and working capital needs.

Authored by FlexiLoans | Date:24/12/2025

- Quick Summary

- What: MSME loans for doctors are collateral-free business loans designed to help medical professionals fund clinic operations, equipment, renovation, and expansion.

- Why: These loans offer fast, flexible funding to support day-to-day medical practice, improve patient services, and manage cash-flow gaps.

- Who: Doctors operating clinics, small hospitals, diagnostic centres, and medical professionals running independent practices.

- How: Learn eligibility, documents, interest rate expectations, and how to apply online through digital-first NBFCs such as FlexiLoans.

- Use Case: A clinic owner secures timely funding to purchase diagnostic equipment and improve patient capacity without pledging assets.

Running a medical practice comes with operational and financial demands. Whether it’s upgrading diagnostic equipment, hiring skilled staff, paying vendors, or expanding into a second clinic, doctors often need access to reliable short- and long-term financing.

Traditionally, medical professionals were required to pledge property or high-value equipment as collateral to secure loans. This created barriers for many established practitioners who preferred not to risk personal or business assets.

MSME loans for doctors have transformed this landscape. Digital NBFCs such as FlexiLoans enable medical professionals to obtain fast, collateral-free loans with minimal paperwork and transparent approval processes.

This guide walks you through everything you need to know about MSME loans for doctors, including eligibility, documentation, benefits, interest rate expectations, and how to apply online.

What Are MSME Loans for Doctors?

An MSME loan for doctors is a collateral-free business loan that supports medical professionals who operate clinics, nursing homes, diagnostic centres, or private practices. Unlike traditional secured loans, these loans do not require doctors to pledge assets such as property, machinery, or medical infrastructure.

Approval is generally based on the doctor’s financial profile, business turnover, credit score, and clinic performance. MSME loans help bridge funding gaps for:

- Clinic renovation.

- Medical equipment or device upgrades.

- Hiring and training medical staff.

- Working capital for medicines and consumables.

- Expanding to a second practice or speciality area.

- Setting up digital tools such as EMR systems.

Why Doctors Need MSME Loans?

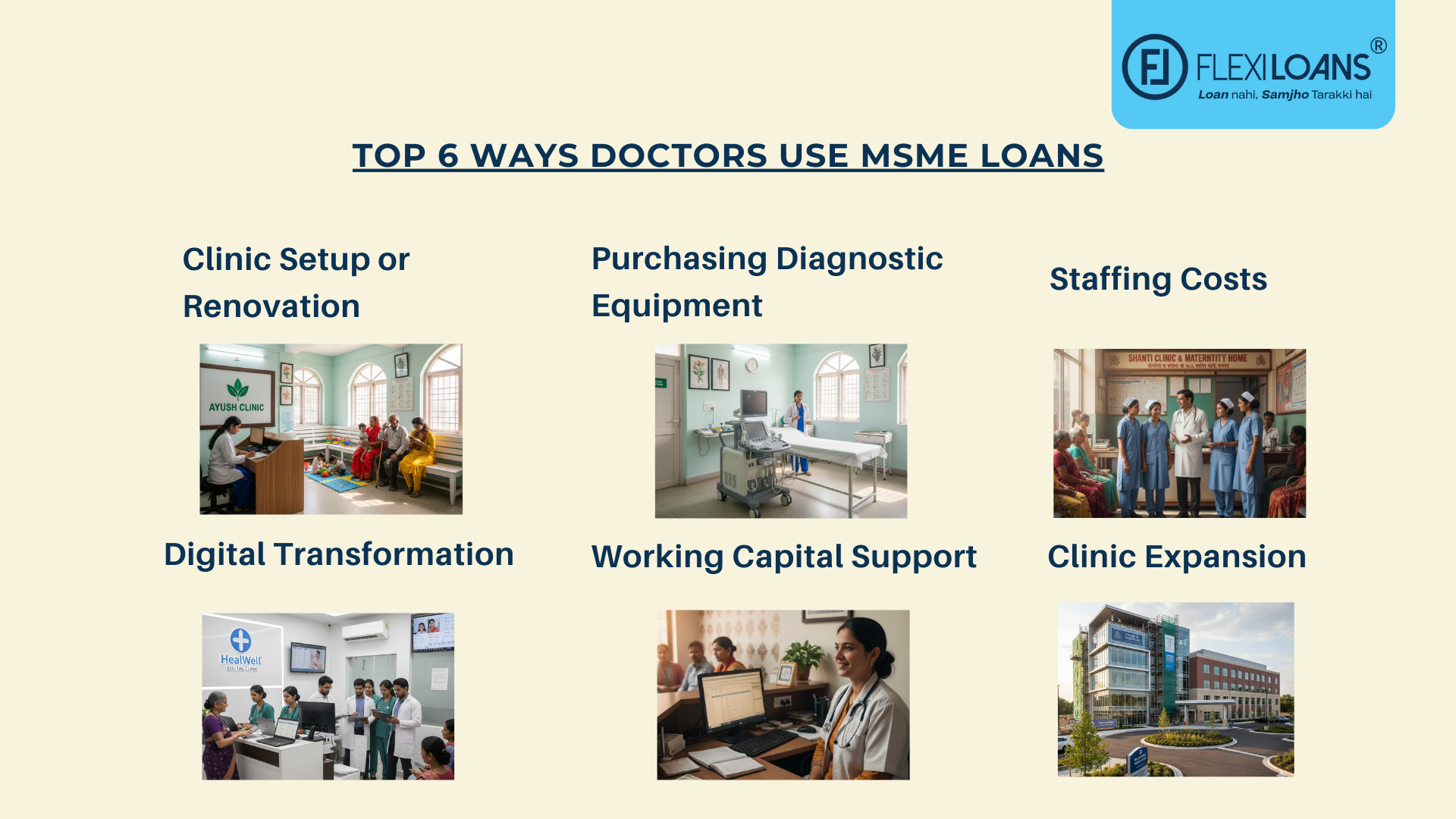

Doctors require financial support for a variety of clinical and operational needs. MSME loans can support:

1. Clinic Setup or Renovation

Modernising a practice enhances patient trust and supports higher footfall.

2. Purchasing Diagnostic Equipment

Ultrasound machines, ECG devices, dental chairs, ophthalmic tools, and lab machines often require a high upfront investment.

3. Staffing Costs

Hiring nurses, technicians, receptionists, and support staff improves service quality.

4. Digital Transformation

Implementing EMR, teleconsultation systems, digital appointment tools, and online billing enhances efficiency.

5. Working Capital Support

Inventory for pharmacy operations, consumables, vendor payments, and day-to-day clinic expenses.

6. Clinic Expansion

Opening a second clinic or adding new specialties such as dermatology, orthopaedics, or paediatrics.

These practical needs make MSME loans a preferred tool for doctors aiming to improve patient care and operational growth.

What are the Key Benefits of MSME Loans for Doctors in 2026?

Doctors and medical professionals experience several advantages when opting for an MSME loan:

- No Collateral Required: Borrow without risking property or medical assets.

- Fast Disbursal: Digital NBFCs typically disburse funds within 48–72 hours of approval.

- Flexible Loan Amounts: Borrow based on business requirements and financial profile.

- Minimal Documentation: Digital KYC and financial records make the application simple.

- Versatile Usage: Funds can be used for equipment, renovation, staffing, or working capital.

- Cash-Flow Friendly EMIs: Repayment plans aligned with clinic revenues.

What are the Eligibility Criteria and Documents Required for availing MSME Loans for Doctors?

Eligibility

Doctors can apply if they meet the following general criteria:

- Minimum business/clinic vintage of 1–2 years.

- Monthly business turnover of at least ₹2 lakh.

- CIBIL score of 700 or above.

- An Indian citizen aged between 21 and 65 years.

- Running a registered clinic, nursing home, or diagnostic centre.

Documents Required (Digital Submission)

- PAN card and Aadhaar card.

- Medical registration certificate (MBBS, BDS, BHMS, BAMS, BPT, or specialist degree).

- Clinic registration or professional establishment proof.

- Last 6–12 months’ bank statements.

- GST returns (where applicable).

- Basic financial documents as requested during the assessment.

What are the Average Interest Rates for MSME Loans for Doctors?

Interest rates vary depending on the lender type and the applicant’s profile:

| Lender Type | Typical Interest Rate (p.a.) | Segments Served |

| Public Banks | 12% – 16% | Established clinics with strong credit history |

| Private Banks | 14% – 20% | Medical practices with stable turnover |

| NBFCs & Fintechs | 15% – 24% | MSMEs, solo practitioners, small centres |

At FlexiLoans, MSME loans start from 1% per month, based on turnover, cash flow, business performance, and creditworthiness.

What are the Steps to Secure an MSME Loan Successfully?

Follow these essential steps to improve your chances of securing an MSME loan for your clinic, hospital, or diagnostic centre.

1. Register on the Udyam Portal

Udyam Registration formally recognises your clinic as an MSME and strengthens your eligibility for collateral-free MSME loans. Complete it online using your PAN and Aadhaar.

2. Check Your Credit Score

A credit score of 750+ increases your chances of approval. Review your report and resolve any pending issues before applying.

3. Choose the Right Lender

Compare MSME loan interest rates, loan amounts, and repayment terms. Digital NBFCs like FlexiLoans offer faster approvals and minimal documentation for doctors.

4. Select the Correct Loan Amount

MSME loan amounts range from ₹50,000 to a few crores. Choose an amount that fits your clinic’s needs, such as expansion, equipment, or working capital, without over-borrowing.

5. Explore Government Schemes

Schemes like CGTMSE offer collateral-free credit guarantees for loans up to ₹5 crore, reducing your financial risk.

6. Review Eligibility Criteria

Most lenders require:

- Valid medical degree (MBBS, BDS, BAMS, etc.)

- Registered clinic

- 1–2 years of practice

- Stable monthly turnover

7. Choose Online or Offline Application Mode

Online applications are faster and convenient for busy practitioners. Some public banks may still require offline submission.

8. Submit the Required Documents

Keep your KYC, medical registration, clinic proof, bank statements, and GST/IT returns ready for quick processing.

Why Choose FlexiLoans for Your MSME Loan?

FlexiLoans is trusted by thousands of business owners across India. For medical professionals, we offer:

- Fast loan disbursal within 48–72 hours.

- Minimal documentation and 100% digital processing.

- Collateral-free MSME loans tailored to clinic needs.

- Transparent charges with zero hidden fees.

- Loan amounts ranging from ₹50,000 to ₹50 lakh.

- EMIs are designed around clinic cash flow patterns.

What are the Pro Tips to Improve Your MSME Loan Approval?

- Maintain a CIBIL Score Above 700 for better chances of approval.

- Borrow Only What You Need to avoid unnecessary interest.

- Keep Digital Documents Ready, especially bank statements and GST filings.

- Compare Tenure and EMI Options before finalising the loan.

- Provide Accurate Information to avoid delays or rejection.

MSME loans have become essential for doctors seeking to expand services without risking their personal assets. With digital lenders like FlexiLoans, medical professionals can secure fast, collateral-free funding to grow confidently.

Conclusion

MSME loans for doctors are a powerful resource for medical professionals seeking fast, flexible, and collateral-free funding. Whether you are upgrading equipment, expanding your clinic, or managing operational cash flow, these loans provide the support you need to grow your practice sustainably.

With digital NBFCs like FlexiLoans, you can access funding within 72 hours, eliminate asset-pledging barriers, and focus entirely on delivering quality patient care.

FAQs: MSME Loans for Doctors

An MSME loan for doctors is a collateral-free business loan designed to help medical professionals fund clinical operations, equipment purchases, working capital needs, or expansion without having to pledge assets.

Doctors running a registered clinic, nursing home, or diagnostic centre with 1–2 years of operational history, a stable monthly turnover, and a CIBIL score of 700 or above can apply.

Digital lenders and NBFCs like FlexiLoans typically offer fast approval and disbursal within 48–72 hours, provided documents and eligibility criteria are met.

Commonly required documents include PAN, Aadhaar, medical registration certificate, clinic registration proof, recent bank statements, and GST returns (if applicable).

Yes. MSME loans are widely used to purchase or upgrade medical equipment, such as diagnostic devices, dental chairs, lab equipment, and essential clinical tools.

No. MSME loans offered by FlexiLoans are completely collateral-free, with transparent terms and flexible repayment options tailored for medical professionals.

Glossary: Key Terms Explained

| Term | Definition |

| MSME Loan | A business loan offered to micro, small, and medium enterprises. |

| Collateral-Free Loan | A loan granted without pledging assets such as property or equipment. |

| CIBIL Score | A credit score between 300 and 900 represents financial credibility. |

| NBFC | Non-Banking Financial Company providing lending services digitally. |

| Working Capital | Funds needed for day-to-day clinic operations. |

| Disbursal | The transfer of loan funds to the borrower’s account. |

| EMR | Electronic Medical Records for digital patient management. |

Is this information helpful?