Dec 22, 2025

Jan 09, 2026

A complete guide to MSME loan interest rates, how they are calculated, and what business owners can expect in 2026

Authored By FlexiLoans | Date: 22/12/2025

- Quick Summary

- What: MSME loan interest rates determine the total cost of borrowing for small and medium enterprises. Rates vary by lender type, business profile, loan amount, and repayment tenure.

- Why: Understanding how interest is calculated helps MSMEs estimate their repayment burden, select the right lender, and manage cash flow effectively.

- Who: Business owners, traders, service providers, manufacturers, and professionals applying for MSME loans in 2026.

- How: Learn the types of interest calculation methods, factors influencing MSME loan rates, and how digital NBFCs such as FlexiLoans offer transparent, collateral-free terms.

- Use Case: A manufacturing unit takes a ₹5 lakh MSME loan and uses simple interest and EMI formulas to understand the total cost before applying.

Getting an MSME loan is one of the fastest ways for small businesses to access working capital, buy equipment, hire staff, or manage expansion. However, the real cost of the loan depends on the interest rate applied, the calculation method, and the repayment structure.

Most business owners focus only on the percentage figure (e.g., 15% per annum) but do not evaluate how EMI is calculated or how reducing-balance interest affects total repayment.

This guide explains MSME loan interest rates in detail: the calculation methods, examples, factors influencing rates, and the latest interest range for 2026, so MSME owners can make informed borrowing decisions.

What Are MSME Loan Interest Rates?

MSME loan interest rates are the costs lenders charge for providing business funding. This rate determines the EMI you pay every month and the total amount you ultimately repay.

For MSMEs, interest rates vary depending on:

- Lender category.

- Borrower creditworthiness.

- Turnover and cash flow.

- Business stability.

- Financial documents and banking behaviour.

Interest rates for MSME loans typically fall into defined ranges across public banks, private banks, and NBFCs.

How Are MSME Loan Interest Rates Calculated?

Lenders calculate interest using two primary methods:

1. Flat Interest Rate Method (Less Common)

Interest is calculated on the entire principal amount throughout the loan tenure.

The monthly principal does not reduce.

2. Reducing Balance Method (Most Common for MSMEs)

Interest is calculated only on the outstanding principal every month.

As you repay EMIs, the outstanding amount decreases, resulting in lower interest over time.

Why Reducing Balance Matters:

Most digital lenders, including NBFCs, follow this method because it is more transparent and results in lower total interest cost.

Flat Rate vs. Reducing Balance Method

| Feature | Flat Rate | Reducing Balance |

| Interest Applied On | Full loan amount | Remaining outstanding |

| Monthly Interest | Same every month | Decreases monthly |

| Transparency | Low | High |

| Total Cost | Higher | Lower |

| Common For | Small consumer loans | MSME business loans |

EMI Calculation Example (₹5 Lakh Loan)

Let’s calculate EMI for a standard MSME loan:

- Loan Amount: ₹5,00,000

- Interest Rate: 15% per annum

- Tenure: 36 months

EMI Formula Used (Reducing Balance):

EMI = [P × r × (1+r)^n] / [(1+r)^n – 1]

Where:

P = Loan Amount

r = Monthly Interest Rate

n = Number of Months

Calculation:

- r = 15% / 12 = 0.0125

- n = 36 months

Approx EMI: ₹17,361

Total Repayment: ₹6,25,000 (approx)

Total Interest: ₹1,25,000 (approx)

This example helps MSMEs estimate repayment and plan cash flow effectively.

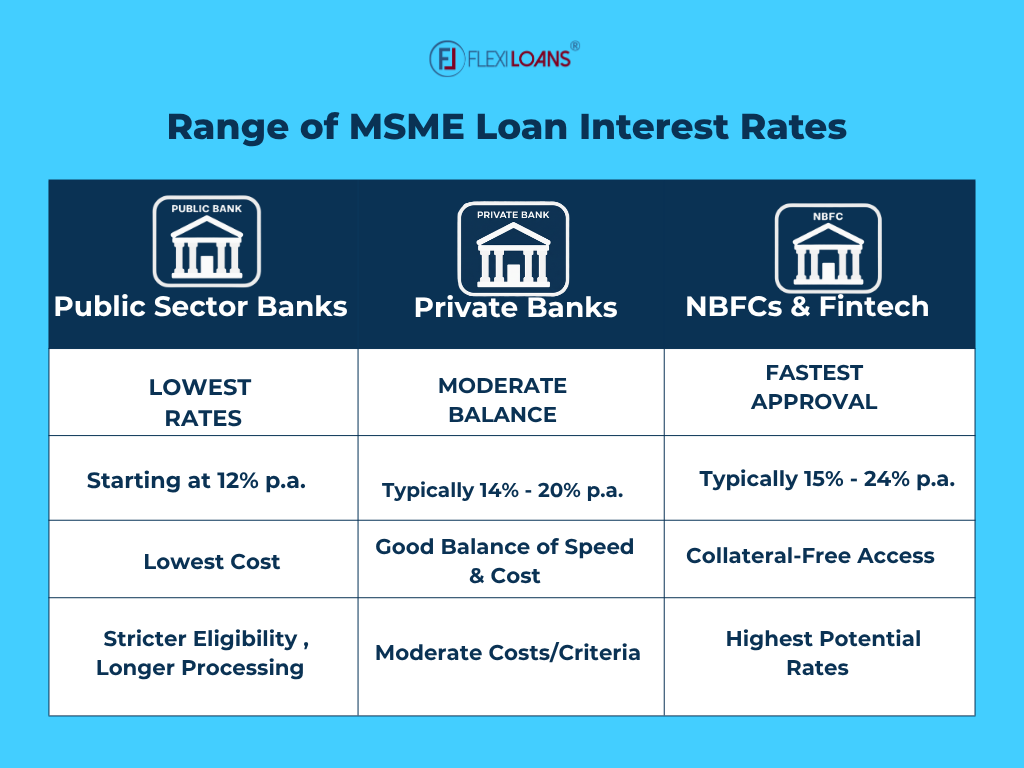

Interest rates vary depending on the type of lender and business profile. Here are safe, industry-verified ranges:

What are the Average Interest Rates for MSME Loans?

| Lender Type | Typical Interest Rate (p.a.) | Who It Suits |

| Public Banks | 12% – 16% | MSMEs with strong credit history |

| Private Banks | 14% – 20% | Growing businesses with steady turnover |

| NBFCs & Fintech Lenders | 15% – 24% | MSMEs, traders, manufacturers, service providers |

At FlexiLoans, MSME loan rates start from 1% per month, based on turnover, cash flow, business stability, and creditworthiness.

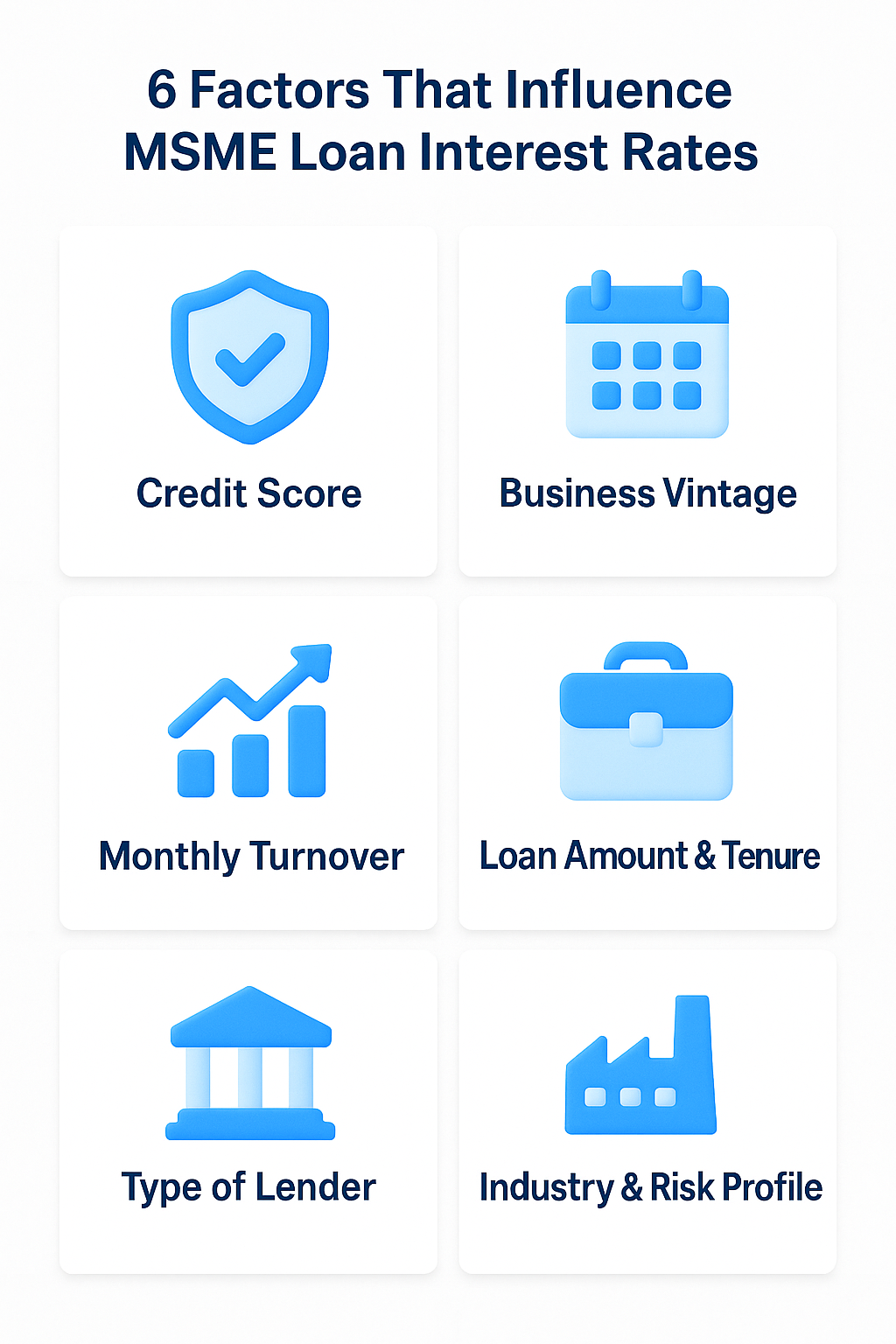

What are the Factors That Influence MSME Interest Rates?

Interest rates for MSME loans depend on several business and financial factors:

1. Credit Score

A score of 700+ can help secure better interest rates.

2. Monthly Turnover

Higher, consistent turnover reduces perceived risk.

3. Cash Flow Stability

Regular, healthy bank statements favour better rates.

4. Business Vintage

Businesses operating for 1–2 years or more receive more competitive rates.

5. Financial Documents

Tax filings, banking behaviour, and repayment history influence rates.

6. Loan Amount & Tenure

Larger loan amounts or longer tenures may attract different pricing.

How to Get the Best MSME Loan Interest Rate?

To secure lower interest rates:

- Maintain a CIBIL score above 700.

- Reduce credit utilisation.

- Ensure clean banking behaviour (no frequent overdrafts).

- File GST and tax returns regularly.

- Choose shorter tenures if suitable for your cash flow.

- Apply through digital NBFCs for faster approvals.

Why Choose FlexiLoans for MSME Loans?

FlexiLoans is one of India’s leading digital lenders for MSMEs, offering:

- Loan disbursal within 48–72 hours.

- Minimal documentation and paperless processing.

- Collateral-free MSME loans.

- Transparent, fair pricing with zero hidden charges.

- Loan amounts from ₹50,000 to ₹50 lakh.

- EMIs tailored to business cash flow.

What are the Pro Tips to Improve Your MSME Loan Approval?

- Keep your CIBIL score above 700.

- Borrow only what your business needs.

- Maintain accurate financial records.

- Keep GST and bank statements up to date.

- Provide consistent and accurate application information.

In 2026, understanding how MSME loan interest is calculated will be just as important as choosing the loan itself. Transparent, collateral-free lenders like FlexiLoans help MSMEs borrow confidently with clarity on actual repayment cost.

Conclusion

Understanding MSME loan interest rates helps business owners make smarter borrowing decisions. By learning how interest is calculated, comparing lender ranges, and evaluating your financial profile, you can estimate your repayment more accurately.

Digital NBFCs like FlexiLoans offer fast, collateral-free MSME loans with transparent pricing, helping businesses access funding without delay and manage growth effectively.

FAQs: MSME Loan Interest Rates (2026)

MSME loan interest rates represent the cost of borrowing for small and medium enterprises, calculated annually and added to the EMI.

Most lenders use the reducing balance method, in which interest is applied to the outstanding loan balance each month.

Your credit score, turnover, cash flow, business vintage, and documentation play significant roles.

Public banks range from 12–16%, private banks from 14–20%, and NBFC/fintech lenders from 15–24%.

FlexiLoans offers MSME loans starting from 1% per month, subject to turnover and credit assessment.

Glossary: Key Terms Explained

| Term | Definition |

| EMI | Monthly repayment amount combining interest and principal. |

| Reducing Balance | An interest method where interest applies only to the remaining principal. |

| Flat Rate | An interest method in which interest is applied to the full loan amount throughout the tenure. |

| NBFC | Non-Banking Financial Company offering loans digitally. |

| CIBIL Score | Credit score indicating repayment capability (300–900). |

| Disbursal | Transfer of loan funds to the borrower’s account. |

| Working Capital | Funds used for daily business operations. |

Is this information helpful?