Jan 31, 2026

Feb 06, 2026

Understanding how MSMEs can manage receivables delays and working capital needs efficiently.

Authored by FlexiLoans | Date: 31/01/2026

- Quick Summary

- What: TReDS is a digital platform for invoice discounting, while working capital business loans provide direct funding to manage short-term business expenses.

- Why: MSMEs supplying to CPSEs often face delayed payments, making cash flow management critical for daily operations and growth.

- Who: MSMEs, vendors, and service providers working with CPSEs and large corporates.

- How: Businesses can either discount invoices through TReDS or access working capital loans to maintain liquidity.

- Use Case: An MSME supplying to a CPSE uses TReDS to unlock invoice value while also evaluating a working capital loan to cover operational expenses during payment cycles.

Cash flow delays are a persistent challenge for MSMEs, especially those supplying goods or services to CPSEs. While government-backed platforms like TReDS aim to address receivable delays, they may not always meet every working capital requirement.

To manage liquidity effectively, MSMEs must understand the difference between invoice-based financing through TReDS and traditional working capital business loans. Each serves a distinct purpose, and choosing the right option depends on urgency, cash flow structure, and business needs.

Let’s explain how TReDS works for CPSE-linked MSMEs, how working capital loans differ, and how businesses can decide the fastest way to fix cash flow gaps.

What Is TReDS and How Does It Work for CPSEs?

The Trade Receivables Discounting System is an RBI-regulated digital platform that allows MSMEs to discount invoices raised on large buyers, including CPSEs. Once an invoice is approved by the buyer, financiers bid to discount it, thereby providing the MSME with early payment.

Key aspects of TReDS include:

- Invoices must be accepted by the CPSE buyer.

- Financing is based on approved receivables, not future projections.

- Payment responsibility remains with the buyer at maturity.

This system is designed to ease liquidity stress caused by delayed receivables.

TReDS Registration Process for MSMEs

To use TReDS, MSMEs must register on an authorised TReDS platform. The process typically involves:

- MSME registration and KYC verification.

- Onboarding of the CPSE or corporate buyer on the same platform.

- Uploading invoices raised by the buyer.

- Buyer confirmation and acceptance of invoices.

- Discounting through participating financiers.

Only approved invoices can be discounted, making buyer participation essential.

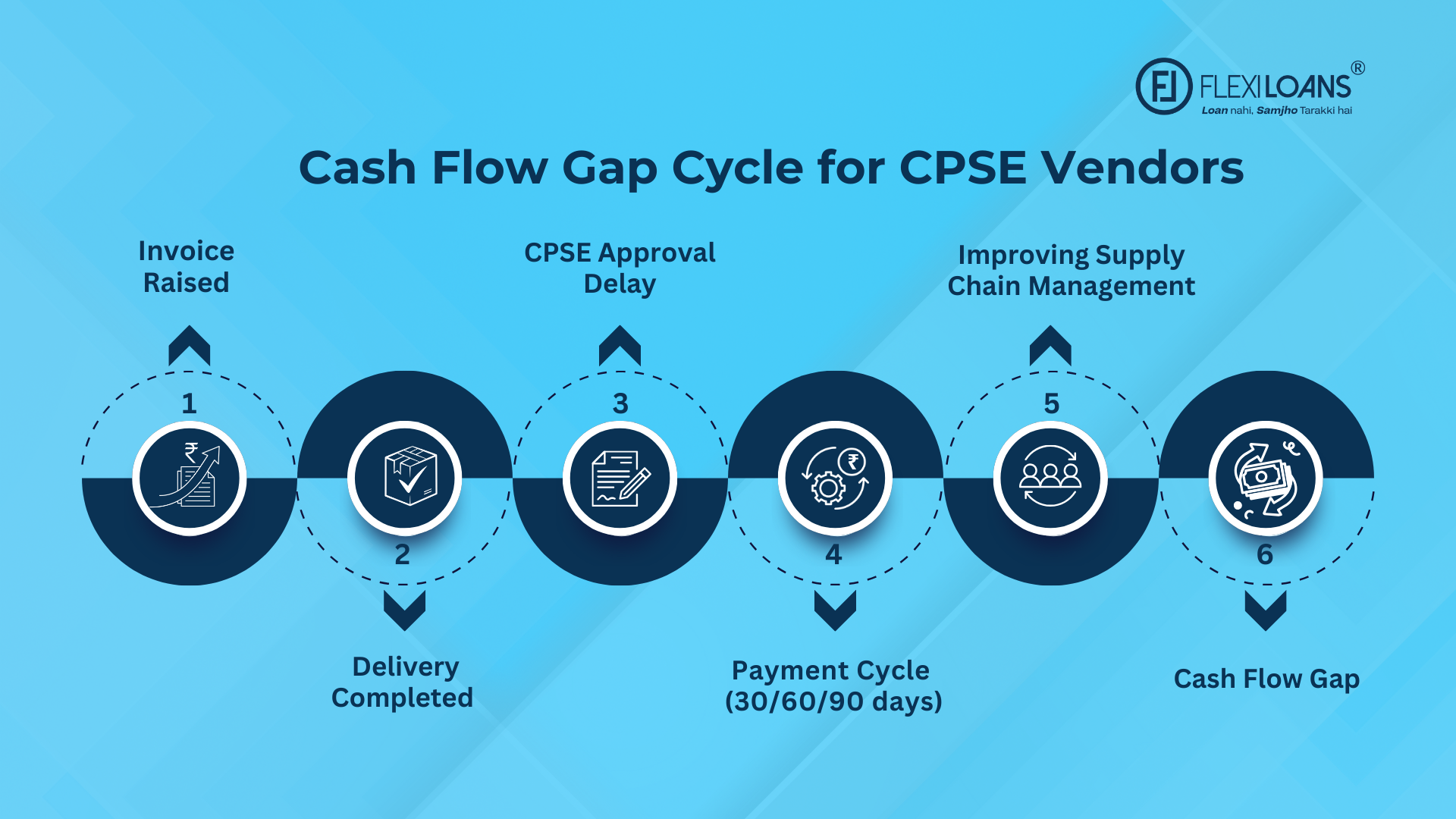

Why MSMEs Supplying to CPSEs Face Cash Flow Gaps

Even with structured procurement systems, MSMEs supplying to CPSEs often experience:

- Payment cycles extending beyond standard credit periods.

- High working capital locked in receivables.

- Ongoing expenses such as salaries, rent, and raw material costs.

- Limited flexibility to delay operational payments.

These gaps create a need for faster liquidity solutions beyond receivables financing alone.

Working Capital Business Loans Explained

Working capital business loans provide MSMEs with funds to manage daily operational expenses. Unlike TReDS loans, these loans are not linked to specific invoices and can be used flexibly to meet business needs.

Working capital loans typically support:

- Payroll and vendor payments.

- Inventory procurement.

- Short-term operational expenses.

- Cash flow smoothing during revenue gaps.

Digital lenders assess turnover, bank statements, and credit profiles to offer these loans.

TReDS vs Working Capital Business Loans: Key Differences

| Aspect | TReDS | Working Capital Business Loan |

| Funding basis | Approved invoices | Business cash flow and credit |

| Dependency on the buyer | Mandatory | Not required |

| Usage flexibility | Limited to receivables | Fully flexible |

| Speed of access | Depends on invoice approval | Faster once approved |

| Repayment | Buyer pays the financier | Borrower repays lender |

When TReDS Is the Right Option

TReDS may be suitable when:

- The MSME supplies to CPSEs registered on TReDS.

- Invoices are approved promptly by the buyer.

- Funding needs are directly linked to receivables.

- Short-term liquidity is required against confirmed sales.

It works best as a receivables management tool rather than a comprehensive funding solution.

When a Working Capital Loan Works Better

A working capital loan is often more effective when:

- Cash is needed urgently without waiting for invoice approval.

- Expenses extend beyond receivable cycles.

- The business requires funding flexibility.

- Buyer onboarding on TReDS is not available.

Lending Platforms such as FlexiLoans provide working capital loans that help MSMEs maintain liquidity without being tied to individual invoices.

TReDS plays an important role in easing receivables-related stress for MSMEs supplying to CPSEs. However, businesses often need broader working capital solutions to manage operational expenses that are not linked to specific invoices.

Final Thoughts

Both TReDS and working capital business loans address cash flow challenges, but in different ways. TReDS helps MSMEs unlock value from approved invoices, while working capital loans provide flexibility to manage everyday expenses.

For MSMEs working with CPSEs, understanding when to use each option can significantly reduce cash flow stress and support smoother operations.

FAQs

Ans: TReDS is an RBI-regulated platform that allows MSMEs to discount approved invoices raised on large buyers, including CPSEs, to receive early payments.

Ans: Certain CPSEs are required to onboard on TReDS, but invoice discounting depends on buyer participation and invoice approval.

Ans: Yes. Many MSMEs use TReDS for receivables financing while relying on working capital loans for broader operational needs.

Ans: Working capital loans often provide faster access since they do not depend on invoice approval cycles.

Ans: Yes. Working capital loans help manage expenses that continue regardless of CPSEs’ payment timelines.

Glossary: Key Terms Explained

| Term | Definition |

| TReDS (Trade Receivables Discounting System) | An RBI-regulated digital platform that enables MSMEs to receive early payment by discounting invoices raised on large buyers such as CPSEs and corporates, after buyer acceptance. |

| CPSE (Central Public Sector Enterprise) | A government-owned company in which the Central Government of India holds a majority stake, often acting as a large buyer for MSMEs. |

| Working Capital Loan | A short-term business loan designed to finance day-to-day operational expenses such as payroll, inventory, rent, and vendor payments. |

| Invoice Discounting | A financing mechanism where a business sells its unpaid invoices to a financier at a discount in exchange for immediate liquidity. |

| Receivables | Outstanding payments owed to a business by its customers for goods or services already delivered. |

| Liquidity | The ability of a business to meet its short-term financial obligations using available cash or easily convertible assets. |

| RBI (Reserve Bank of India) | India’s central bank regulates banks, NBFCs, and the financial system, including platforms like TReDS. |

| MSME (Micro, Small, and Medium Enterprise) | A classification of businesses defined by the Government of India based on investment and turnover thresholds. |

| Buyer Acceptance | Formal confirmation by a buyer that an invoice raised by an MSME is accurate and payable is a mandatory step for invoice discounting on TReDS. |

| Financier | A bank, NBFC, or financial institution that provides funding by discounting invoices or issuing business loans. |

| Cash Flow | The movement of money into and out of a business over a specific period indicates its financial health. |

| Digital Lender | A financial institution that uses digital platforms and data-driven processes to offer business loans online. |

| Invoice Maturity | The due date on which the buyer is obligated to pay the invoice amount. |

| Operational Expenses | Recurring costs required to run a business, such as salaries, utilities, rent, and raw materials. |

| Loan Disbursal | The process by which approved loan funds are transferred to the borrower’s bank account. |

Is this information helpful?