Aug 04, 2025

Nov 24, 2025

A step-by-step guide to understanding and leveraging the ASPIRE Scheme, India’s initiative to boost rural entrepreneurship through business incubators.

Authored By FlexiLoans | Date: 23/07/2025

- Quick Summary

- What: A government-backed initiative to promote innovation and entrepreneurship in rural India through Livelihood and Technology Business Incubators

- Why: ASPIRE provides financial support of up to ₹1 crore to institutions that support MSME-led job creation and skill development.

- Who: Best suited for NGOs, technical institutes, industry associations, and universities looking to set up rural incubators

- How: Offers up to ₹75 lakh for LBIs and ₹1 crore for TBIs; applicants must submit proposals via DC-MSME

- Use case: Ideal for institutions planning grassroots development, skilling projects, or incubator-based business models

India’s push for rural entrepreneurship and MSME growth received a strategic boost in 2015 with the launch of the ASPIRE Scheme (A Scheme for Promotion of Innovation, Rural Industries and Entrepreneurship) by the Ministry of MSME.

Through financial grants, up to ₹75 lakh for private agencies and ₹1 crore for government-linked institutions, ASPIRE supports small business creation, skill development, and job generation in underserved regions.

The scheme funds institutions such as Technical Institutes, Universities, Industry Associations, and NGOs to establish Livelihood Business Incubators (LBIs) and Technology Business Incubators (TBIs). These centres nurture agro-based startups and rural innovations through infrastructure, mentorship, and market readiness.

In this blog, we break down who can apply, how much funding is available, and how to unlock ASPIRE’s full potential, whether you aim to set up an incubator or join one as a rural entrepreneur.

Is Your Organisation Eligible for the ASPIRE Scheme?

The ASPIRE Scheme is primarily designed for institutions and registered organisations, not individuals. Its goal is to fund incubators that support entrepreneurship in agro-based sectors, rural industries, and skill development.

Suitability Checklist: Can You Apply?

| Question | Yes/No |

| Are you a registered legal entity in India (NGO, Institute, Association)? | – |

| Do you operate in the agro, rural, or incubation ecosystem? | – |

| Can you set up or expand an incubation centre (LBI or TBI)? | – |

| Does your proposal include employment generation or skill training? | – |

| Are you willing to submit audited project outcomes and reports? | – |

Who Is Eligible to Apply?

Institution Types:

- Technical Institutions (e.g., ITIs, Polytechnics, Engineering Colleges)

- Universities and Academic Bodies – Public or private

- Industry Associations or Chambers

- NGOs and Registered Societies

- MSME Development Institutes (under DC-MSME)

- Existing Incubators/Startup Support Agencies

Sectors Supported Under ASPIRE

| Supported Business Areas | Description |

| Agro-processing Units | Startups adding value to farm produce or organic products |

| Rural Manufacturing | Low-tech production in handlooms, handicrafts, or community goods |

| Skill-Building Centres | Training programs for youth, women, or artisans |

| Village Industries | Small-scale, local employment-generating businesses |

Related ASPIRE Guidelines (PDF)

ASPIRE Scheme: Financial Support & Funding Structure

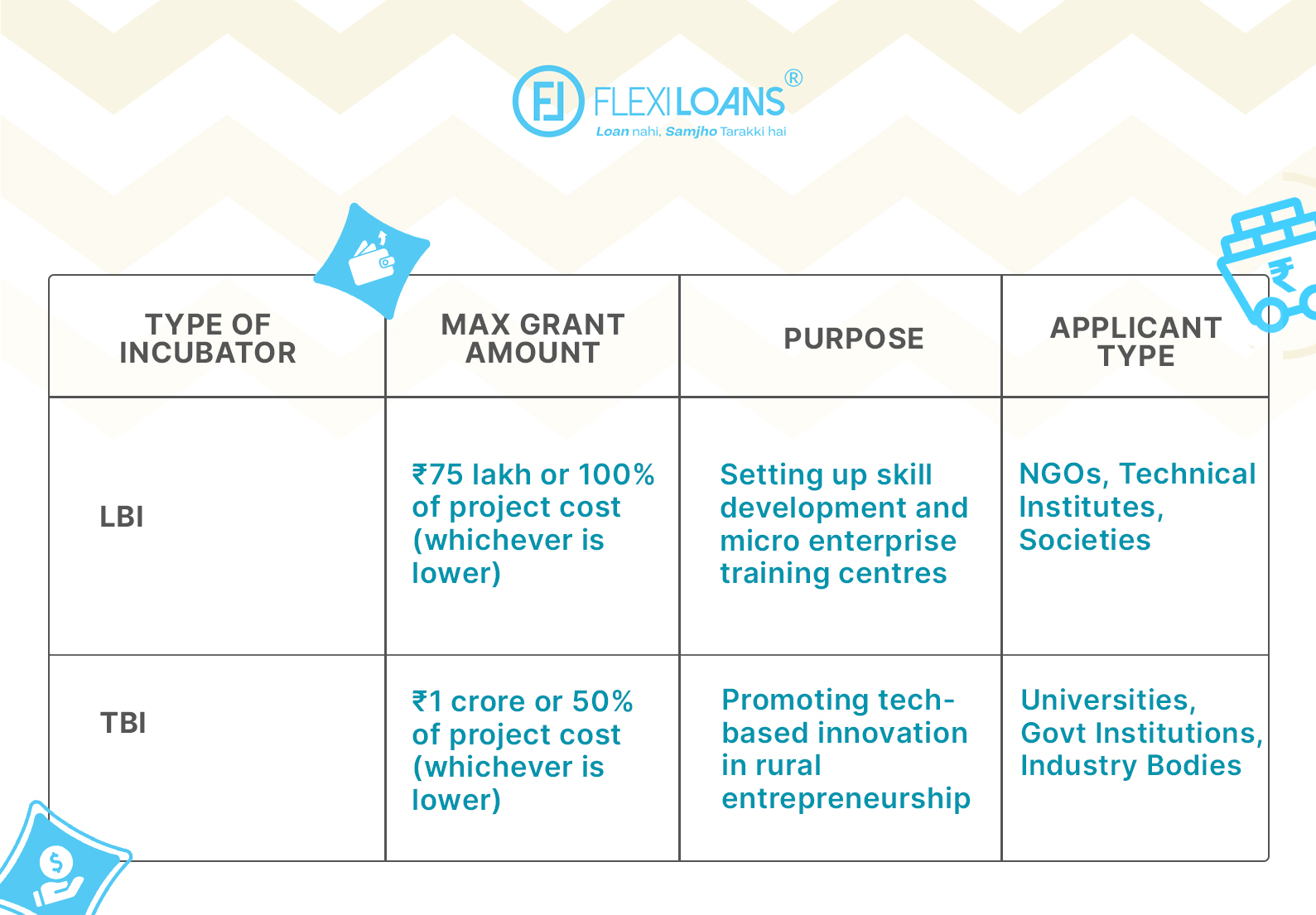

One of the most compelling reasons to apply for the ASPIRE Scheme is the financial assistance it provides. Whether you’re setting up a Livelihood Business Incubator (LBI) or a Technology Business Incubator (TBI), the scheme offers structured support tailored to the scale and nature of your initiative.

Funding Overview

Note: Funds are released in instalments post-approval, based on project milestones and submission of utilisation certificates.

Key Financial Guidelines

- Recurring vs Non-Recurring: Grants cover infrastructure setup, basic machinery, training kits, and operational expenses for a limited period.

- Utilization Timeline: Most grants must be utilized within 2 years from disbursal.

- No Direct Subsidy to Individuals: Funds are only released to eligible institutions, not directly to entrepreneurs.

How to Apply for the ASPIRE Scheme: Step-by-Step Guide

Applying for the ASPIRE Scheme can open doors to valuable funding and infrastructure support, especially if you’re an institution committed to rural development and entrepreneurship. Here’s a clear breakdown of the application process:

- Step 1: Check Your Eligibility

Before starting, ensure your organization qualifies under the official eligibility criteria. You must be a legally registered:

1. Technical or vocational institute (ITI, Polytechnic)

2. University or Engineering College

3. NGO or Registered Society

4. Industry Association

5. Existing Incubator or MSME support organization

Your project proposal should focus on rural innovation or job creation through incubation.

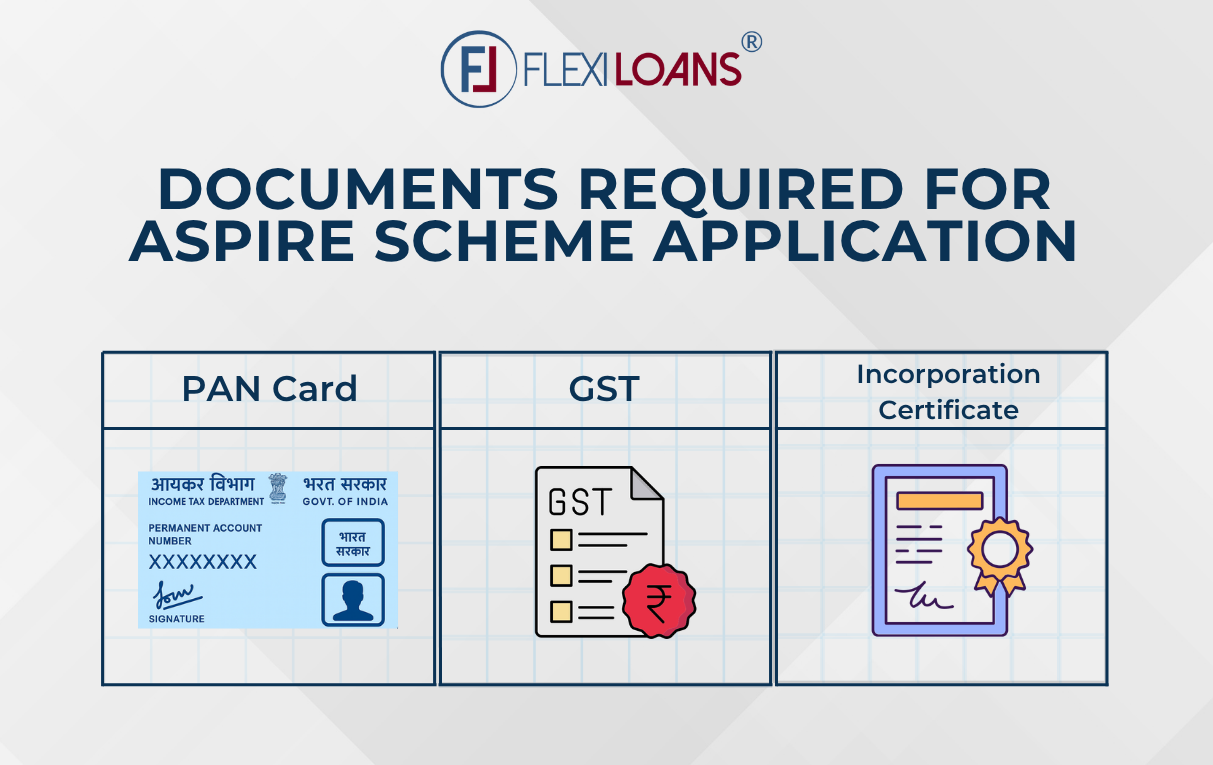

Checklist Tip: Confirm your legal registration status (PAN, GST, and incorporation certificate) and mission alignment with ASPIRE’s objectives. - Step 2: Prepare a Detailed Project Proposal

You’ll need a comprehensive proposal outlining:

1. The type of incubator you plan to establish (LBI or TBI)

2. Training modules, technologies used, and target beneficiaries

3. Infrastructure and equipment needs

4. Expected job creation and community impact

Include budget estimates and fund utilization plans with a clear project timeline. - Step 3: Submit Your Application to DC-MSME

Submit your proposal to the Development Commissioner (MSME) via:

1. Online (if submission is enabled on the MSME portal)

2. Physical submission to the nearest MSME-DI or DC-MSME office

Make sure to attach:

1. Project report

2. Entity registration documents

3. Bank account details

4. Board resolution or authorisation letter - Step 4: Await Scrutiny and Approval

Your application will be evaluated by a screening committee at the DC-MSME. Evaluation parameters include:

1. Feasibility and sustainability of your incubation model

2. Social and economic impact

3. Alignment with ASPIRE’s mission

If approved, the grant is released in stages upon meeting specific milestones.

Estimated Timeline

| Process Stage | Time Estimate |

| Proposal Preparation | 2–3 weeks |

| Submission & Scrutiny | 4–6 weeks |

| Fund Disbursement | Phase-wise post-approval |

Key Benefits of the Aspire Scheme

The ASPIRE Scheme is more than just a funding initiative; it’s a strategic enabler for rural entrepreneurship, skill-building, and job creation in India. Here’s a closer look at the tangible benefits it offers to both incubator institutions and MSMEs supported through its network.

1. Financial Assistance for Incubator Development

Institutions setting up Livelihood Business Incubators (LBIs) or Technology Business Incubators (TBIs) can access funding up to ₹1 crore. This capital is critical for building physical infrastructure, purchasing training equipment, and creating an innovation-friendly environment. For many NGOs and technical bodies, this eliminates the cost barrier associated with launching new incubation centres in underserved areas.

Grant Highlight: ₹75 lakh (for LBI) and ₹1 crore (for TBI) with streamlined application and disbursement process through DC-MSME.

2. Boosting Rural Employment Through Skill Training

ASPIRE-backed LBIs are designed to train youth and small entrepreneurs in trades like food processing, handicrafts, agri-tech, and repair services. By providing hands-on learning and job-oriented training, the scheme addresses regional unemployment and migration.

Impact Tip: Rural incubators under ASPIRE have trained thousands across India, especially in Tier 3 and remote districts.

3. Strengthening the MSME Innovation Pipeline

By funding incubators focused on innovation-led entrepreneurship, ASPIRE encourages the development of sustainable, scalable MSMEs. TBIs often support technology-enabled micro-enterprises tackling challenges in agriculture, clean energy, and rural supply chains, paving the way for inclusive growth.

4. Simplified Access to Government Resources

Unlike many central schemes, ASPIRE simplifies the process for registered institutions to apply. With minimal paperwork and a focus on outcome-based proposals, organisations can receive support without extensive bureaucratic delays.

Pro Tip: Application forms and operational guidelines are available on the official ASPIRE scheme page, making the process transparent and accessible.

5. Enabling Credit and Capital for Startups

While ASPIRE itself doesn’t provide direct loans, MSMEs incubated through LBIs and TBIs often become eligible for government-backed loan schemes such as CGTMSE or find partners like NBFCs (including FlexiLoans) for startup funding. This incubation-to-credit pathway is key for early-stage businesses.

Many MSMEs benefit from other complementary government schemes, as well. If you’re looking to expand your knowledge, explore some of the top government schemes available to MSMEs in India.

ASPIRE isn’t just a funding scheme, it’s a strategic initiative that nurtures rural entrepreneurship and innovation. By bridging financial support with incubation, it enables grassroots businesses to thrive in sectors that matter most to India’s inclusive growth.

Common Mistakes & Tips to Avoid Rejection

Many Aspire Scheme applications are rejected not because the ideas lack merit, but due to errors in documentation or proposal structure. This section outlines common pitfalls and practical advice to ensure your proposal stands out and meets all criteria set by the Ministry of MSME.

1. Submitting an Incomplete or Vague Project Proposal

One of the most frequent reasons for rejection is the absence of a well-structured project plan. Applicants often submit proposals lacking clarity on objectives, expected outcomes, implementation strategy, or budget allocation.

Tip: Always provide a detailed business proposal that clearly outlines your project’s impact on local entrepreneurship, potential for job creation, target beneficiaries, and expected growth metrics. Include realistic milestones and timelines to build credibility.

2. Missing Mandatory Documents

Failure to submit key documents such as registration certificates, bank details, or past incubation credentials can result in delays or outright rejection. Even minor mismatches in details (e.g., name or PAN number discrepancies) may raise red flags during verification.

Tip: Use a standard checklist of required documents and verify every entry twice. Ensure all attachments are clear, signed where needed, and submitted in the prescribed format.

3. Using Outdated Formats or Ignoring Guidelines

Submitting your application using outdated forms or not aligning with the updated Aspire Guidelines can lead to disqualification.

Tip: Refer to the most recent Aspire Scheme Guidelines PDF before you begin. If needed, contact your nearest MSME Development Institute for clarification.

4. Lack of Follow-Up or Responsiveness

Some applications go inactive simply because the applicant failed to respond to clarification emails or verification calls from authorities.

Tip: After submission, maintain regular contact with the relevant MSME-DI or nodal office. Keep records of all communication and track your application status through official channels.

Final Thoughts: Empowering Your Growth Through Aspire

The Aspire Scheme is more than just a funding initiative; it’s a gateway for rural innovators, skill developers, and MSME entrepreneurs to transform local economies. With its focus on incubation, job creation, and low-entry financial support, it is particularly valuable for those seeking grassroots impact with limited resources.

By understanding the application process, avoiding common pitfalls, and leveraging the right support, you increase your chances of success significantly.

If your MSME is preparing for growth, consider how schemes like Aspire can work alongside smart funding solutions from credible NBFCs. Platforms like FlexiLoans help bridge the gap between idea and execution with MSME-focused financial products.

FlexiLoans offers digital-first financing solutions to support your business beyond government schemes.

FAQs

ASPIRE stands for A Scheme for Promotion of Innovation, Rural Industries and Entrepreneurship. It was launched by the Ministry of MSME in 2015 to support business incubators and rural innovation.

Eligible applicants include Technical Institutions, Industry Associations, NGOs, Universities, and MSME Development Institutes that plan to establish Livelihood or Technology Business Incubators.

The scheme offers up to ₹75 lakh for Livelihood Business Incubators (LBIs) and up to ₹1 crore for Technology Business Incubators (TBIs), depending on the project type and cost.

No, ASPIRE does not offer direct funding to individuals. Entrepreneurs can benefit indirectly by joining incubators supported under this scheme.

The scheme focuses on agro-processing, rural manufacturing, village industries, and innovation-based startups aimed at rural development and job creation.

Institutions must submit a detailed project proposal through the official MSME channels, often via their regional MSME Development Institutes. Required documents and proposal guidelines are listed in the official ASPIRE Scheme Guidelines.

Yes, ASPIRE aligns well with other schemes like PMEGP, CGTMSE, and MUDRA loans that provide credit or subsidy to MSMEs supported by incubators.

Glossary: Key Terms in the ASPIRE Scheme

| Term | Definition |

| ASPIRE | A Scheme for Promotion of Innovation, Rural Industries and Entrepreneurship – launched by the Ministry of MSME in 2015 to promote rural business incubation. |

| MSME | Micro, Small, and Medium Enterprises – classified based on investment in plant & machinery and annual turnover. |

| LBI (Livelihood Business Incubator) | Centres set up under ASPIRE to provide skill development, entrepreneurship training, and micro-enterprise incubation in rural areas. |

| TBI (Technology Business Incubator) | Incubators focused on fostering innovation and technology-driven startups in agro and rural sectors, eligible for higher funding under ASPIRE. |

| DC-MSME | Development Commissioner, MSME – the central authority under the Ministry of MSME that coordinates policy and scheme implementation. |

| Project Proposal | A formal document submitted by an institution applying under ASPIRE outlining the business model, expected impact, cost, and implementation plan for an incubator. |

| Utilisation Certificate | A document confirming that funds granted under a scheme like ASPIRE have been used for the intended purpose. Required for release of further instalments. |