Sep 09, 2025

Feb 17, 2026

Understand the Formula, Factors, and Tools to Calculate Your Business’s Working Capital Needs Accurately

Authored By FlexiLoans | Date: 09/09/2025

- Quick Summary

- What: A guide to calculating your business’s working capital needs.

- Why: To ensure smooth operations and prevent cash flow crunches.

- Who: For MSMEs and business owners managing finances.

- How: By using standard formulas and practical examples to estimate working capital.

- Use Case: Helps plan inventory, payments, and short-term financial obligations efficiently.

Planning and managing your business finances effectively begins with a clear understanding of your working capital requirement. Whether you’re preparing budgets, managing liquidity, or seeking funding, an accurate estimate of how much working capital your business needs is essential.

Let us walk you through how to calculate working capital, explore different formulas used, and understand how working capital impacts your business’s ability to operate smoothly and grow sustainably.

What Is Working Capital Requirement?

Working capital, also known as net working capital (NWC), represents a business’s ability to cover its short-term liabilities using its short-term assets. It’s a key financial metric that helps determine if a company has enough liquidity to meet its day-to-day obligations.

A positive working capital indicates that the company has surplus assets to fund its operations or expansion. A negative balance may signal a need for better financial planning or external financing.

Accurately identifying and categorizing current assets and liabilities on the balance sheet is essential for calculating your working capital requirement and evaluating your company’s short-term financial health.

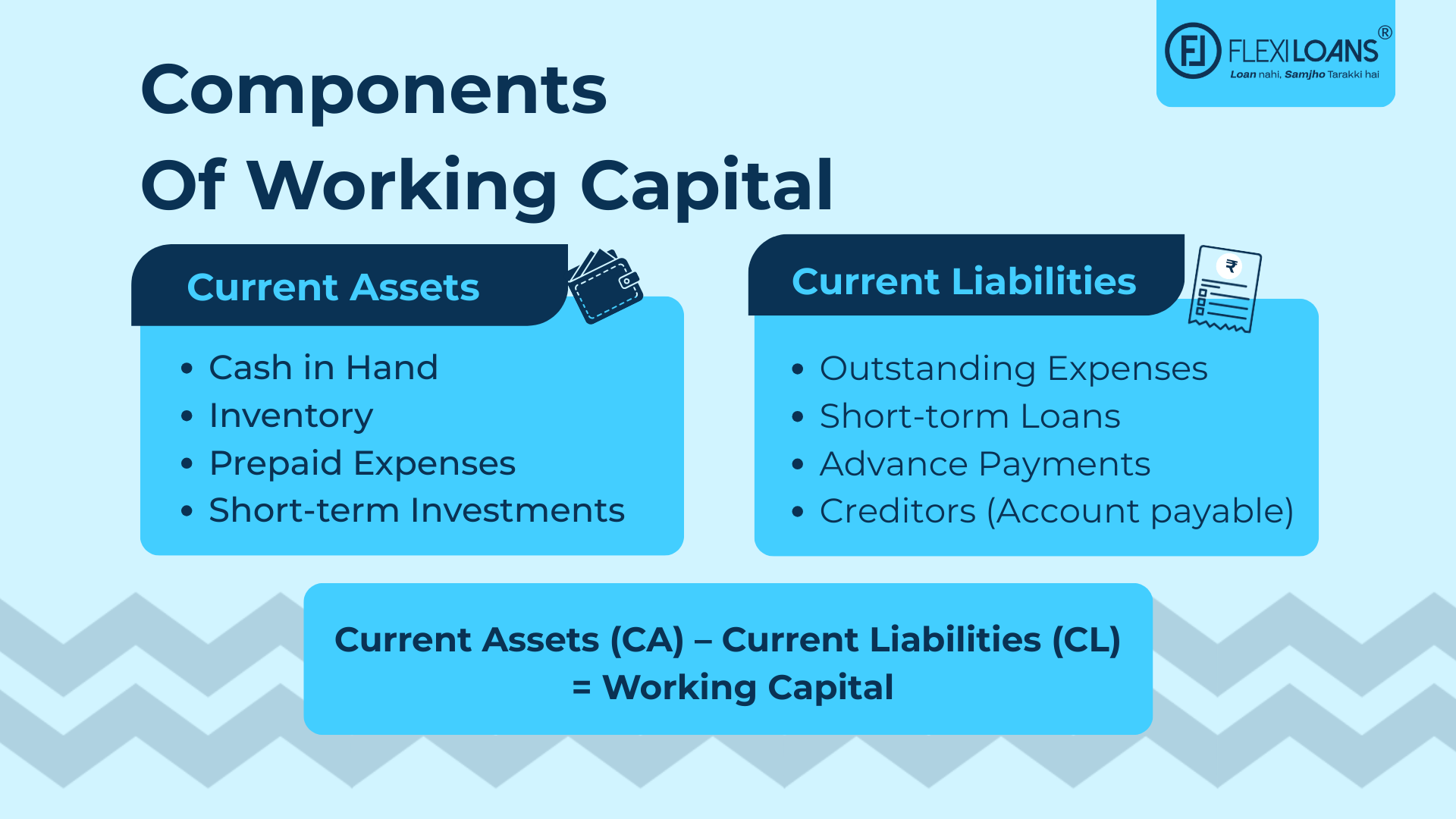

Working Capital Components

Before we learn how to calculate working capital requirement for a firm, consider the following factors that influence working capital.

Current assets

The term, “current assets”, refers to any liquid asset that may be turned into cash during a year. Among them are:

- Money in the bank and consumer cheques that have not yet been deposited

- Prepaid insurance premiums and other expenditures

- An inventory of completed items, raw materials and work-in-progress products

- Accounts receivable without regard for allowances for accounts that are unlikely to be paid

- Payments paid in advance for future purchases

- The company’s short-term investments that it hopes to sell in a year

- Money owed to suppliers or customers that will be paid back during a year, including notes receivable

- Insurance claims, employee cash advances, and income tax returns are examples of receivables.

- Investments in money market funds and other securities

Current liabilities

Your current liabilities include any debts that are due in the year, such as:

- Long-term obligations due during a year

- Amounts owed to creditors

- Taxes owed

- Wages for employees

Business loan interest rate

- Loan principle that must be paid back in a year

- Expenses incurred

- Payments in advance for products and services that have not yet been provided

Types of Working Capital Formulas

You may choose one of the numerous models depending on how precise you or your analyst wants your working capital calculation to be.

The most comprehensive calculation takes into consideration all accounts:

- Some firms choose a more specific calculation for simplicity:

Working Capital = Current Assets (minus cash) – Current Liabilities (minus debt)

- Some people even employ a formula with just three accounts:

Working Capital = Accounts Receivable + Inventory – Accounts Payable

Formula to Calculate the Working Capital

The working capital formula calculates the amount of short-term liquid assets available after short-term obligations are paid off. It is an assessment of the short-term liquidity of a business and is helpful for the management of cash flow, financial analysis and financial modelling.

Step 1: Determine all current assets (CA).

Step 2: Determine all current liabilities (CL).

Step 3: Deduct the CA from the CL (CA – CL).

How to calculate working capital

Below is an example to make you understand how to calculate working capital:

| Current Assets | Amount (Rs.) | Current Liabilities | Amount (Rs.) |

| Debtors | 1.5 lakh | Creditors | 50,000 |

| Unsold inventory | 25,000 | Outstanding expenses | 10,000 |

| Raw materials | 15,000 | ||

| Obsolete stock | 5,000 | ||

| Cash in hand | 25,000 | ||

| Prepaid expenses | 1,500 | ||

| Total | 221,500 | Total | 60,000 |

Working capital = Current assets – Current liabilities

Working capital = Rs. 221, 500 – Rs. 60,000 = Rs. 161,500

So, your company’s working capital is Rs. 161,500.

Importance of Using the Working Capital Formula

The method of calculating working capital provides you with insight into your cash flow position, ensuring that your company has sufficient funds available to support the ongoing success of its operations. This includes fulfilling the financial commitments you have on a day-to-day basis. However, it is also essential for fostering expansion and making your company more resistant to fluctuations in revenue and profits. If you have access to operating cash, you are prepared to deal with any unanticipated expenses.

At the same time, having enough operating cash allows you to rapidly react to new possibilities and assists your company in withstanding any challenges that may arise. At some point or another, the majority of enterprises will experience periods of downtime.

Positive or Negative Working Capital

When a business has positive working capital, it has adequate cash left to pay off short-term loans and support the development of the company’s operations using its resources. This is a promising sign about the organisation’s financial success in the immediate run. Working capital shortages might cause a company to seek outside help from investment bankers or take out a business loan from a financial institution.

When a company’s working capital balance is in the red, its assets are not being used to their maximum potential, and the company faces the danger of a liquidity crisis. Regardless of the amount of money that has been put into purchasing fixed assets, if a company has commitments that are soon to be due, the company will run into problems on both financial and operational fronts. This might lead to the company taking out additional working capital loans, making late payments to its creditors and suppliers, and eventually having a worse corporate credit rating.

How to Deal out Your Working Capital Requirement

A significant number of companies must pay their bills before they can generate any profits from their sales. The delay between outgoing and incoming payments is known as the working capital cycle.

To calculate how long your funds remain tied up, use the:

Working Capital Cycle Formula

Inventory Days + Receivable Days – Payable Days

This indicates the number of days it takes to convert your investments in inventory and receivables back into cash. A shorter working capital cycle is ideal, as it means quicker recovery of funds, stronger liquidity, and fewer financing gaps.

In short, understanding your working capital cycle helps you determine the amount of funding needed to maintain smooth business operations and cover any short-term cash flow gaps.

Working capital is more than just a number—it’s your business’s ability to stay operational, respond to opportunities, and survive uncertainties. A clear understanding of working capital formulas ensures MSMEs don’t just manage cash, but maximise it.

Final Summary

Accurately calculating your working capital requirement helps ensure your business stays financially stable, even during slow seasons or operational delays. Whether using the standard working capital formula or analysing your working capital cycle, these tools give you visibility into how cash flows through your business.

With a clear picture of your liquidity, you can plan more effectively, borrow more intelligently, and avoid unnecessary disruptions. If you’re unsure how to meet your funding gaps, we offer fast, collateral-free business loans designed to keep your operations running without delays.

FAQs

The working capital formula is: Current Assets – Current Liabilities. It helps determine whether your business has sufficient resources to cover its short-term obligations.

Positive working capital indicates that your business has a surplus of current assets to meet its short-term debts and continue operating smoothly.

List all your current assets and current liabilities. Subtract liabilities from assets to get your net working capital.

It’s calculated as: Inventory Days + Receivable Days – Payable Days. It measures how quickly you convert investments into cash.

It helps ensure your business has sufficient liquidity to manage daily operations, respond to emergencies, and avoid unnecessary borrowing.

Yes. Working capital reflects liquidity, while profit shows overall earnings. A profitable business can still face liquidity issues if working capital is poorly managed.

Yes. FlexiLoans offers collateral-free working capital loans specifically designed for SMEs seeking to bridge short-term cash flow gaps.

Glossary: Key Terms Explained

| Term | Definition |

| Working Capital | The money available to cover daily business expenses is calculated as the difference between current assets and current liabilities. |

| Current Assets | Assets expected to be converted into cash within a year, such as inventory, receivables, and bank balances. |

| Current Liabilities | Business obligations due within a year, including vendor payments, taxes, salaries, and short-term loans. |

| Working Capital Cycle | The number of days it takes to turn inventory and receivables into cash, after paying suppliers. |

| Receivables | Payments owed to your business by customers for goods or services delivered. |

| Payables | Amounts your business owes to suppliers, lenders, or service providers. |

| Liquidity | Your business’s ability to meet short-term financial obligations using readily available assets. |

| Inventory | Goods available for sale or in production, including raw materials and finished products. |

| Net Working Capital (NWC) | Another term for working capital; it reflects the net difference between current assets and liabilities. |