Sep 10, 2025

Sep 22, 2025

Avoid Loan Rejections; Learn the Right Way to Make and Submit a Cancelled Cheque for KYC and Loan Verification in 2025

Authored By FlexiLoans | Date: 10/09/2025

- Quick Summary

- What: A cancelled cheque is a blank cheque marked with “CANCELLED” and used as proof of account details for verification, not for transactions.

- Why: Lenders, NBFCs, and other institutions request it during KYC to confirm account name, number, IFSC, and bank branch without requiring sensitive banking activity.

- Who: Anyone applying for loans, opening bank accounts, or completing financial verifications may be asked to provide a cancelled cheque.

- How: Strike two diagonal lines across the cheque and write “CANCELLED” in capital letters between them. Do not sign the cheque.

- Use case: Essential for MSME loan applicants, startups, and anyone applying for digital loans with FlexiLoans or other lenders.

Introduction

If you’ve ever applied for a business loan, opened a new bank account, or completed a Know Your Customer (KYC) form, chances are you’ve been asked to submit a cancelled cheque. It might seem confusing at first, why would someone need a cheque you can’t use to make payments?

A cancelled cheque serves one crucial purpose: verifying your bank account details without risking misuse. It’s a simple, secure way for lenders, NBFCs, and service providers to confirm your account number, IFSC code, bank name, and account holder name.

In this guide, we’ll walk you through everything you need to know, from how to write a cancelled cheque correctly to when and why it’s required. Whether you’re applying for a collateral-free MSME loan through FlexiLoans or completing a standard financial verification, this guide ensures you get it right the first time.

Drawer of the Cheque

A drawer is an individual who orders the bank to issue the specified sum of money written on the cheque. The drawer of the cheque is required to sign the instrument. The bank cannot issue the amount to the drawee if the cheque is unsigned.

Drawee of the Cheque

The drawee is the bank that will pay the amount of money to the person specified in the cheque.

Payee

The payee is the person who receives the specified amount from the bank. The bank is ordered to pay the specified amount as per the drawer’s request to the drawee. There are various types of cheques, such as cancelled, stale, self, open, bank, and crossed cheques. In this article, we will discuss the meaning and uses of a cancelled cheque and how to make a cancelled cheque.

What is a Cancelled Cheque?

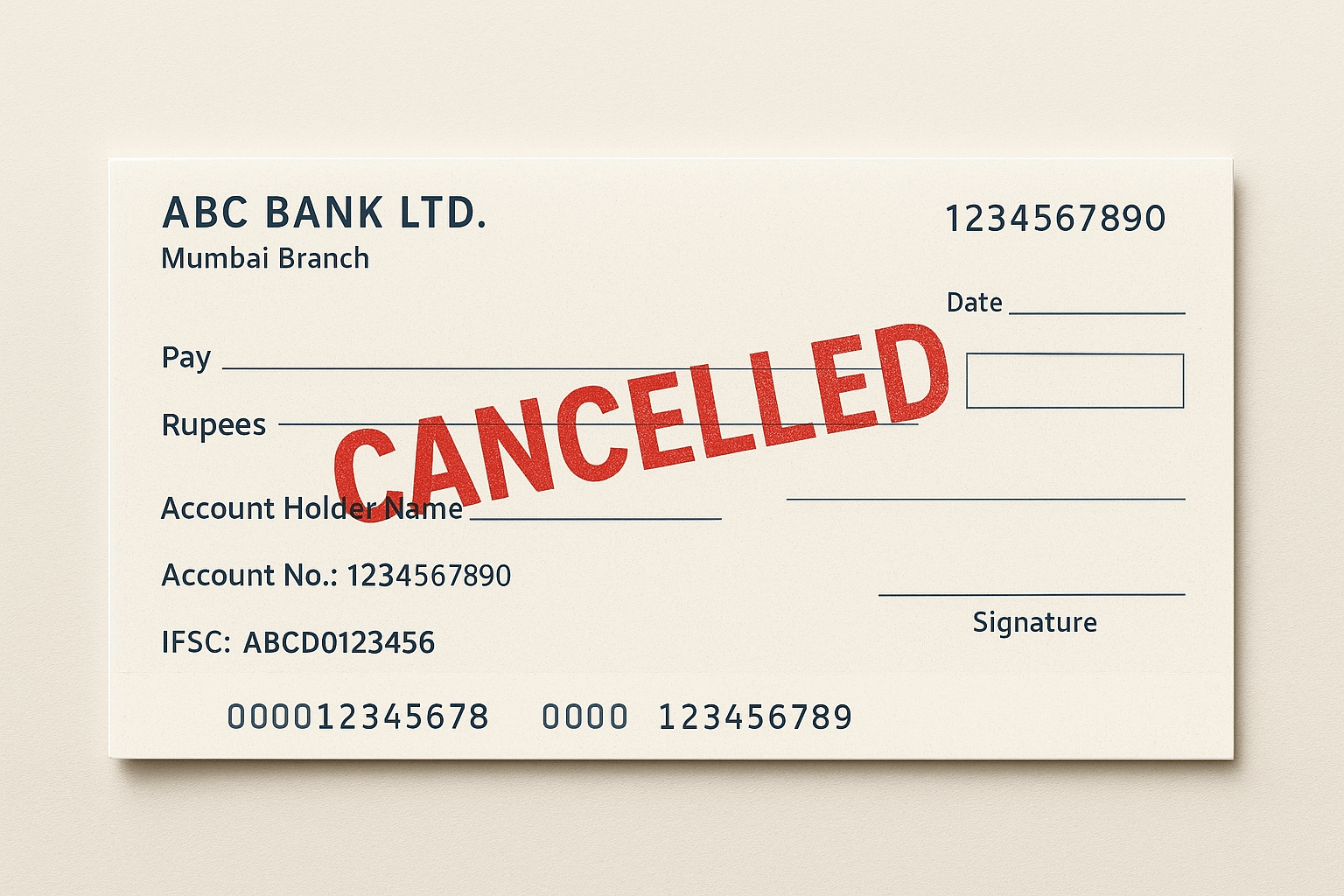

A cancelled cheque is a cheque leaf that has the word “CANCELLED” written across it, typically in large capital letters. Importantly, it is not signed and is not used for financial transactions. Instead, it is provided to third parties as proof of your bank account details.

Though it has no monetary value, a cancelled cheque still reveals critical information, such as:

- Your full name (as per the bank records)

- Bank account number

- IFSC (Indian Financial System Code)

- MICR code (used for cheque processing)

- Branch name and address

Note: Always strike through the cheque with “CANCELLED” using a black or blue pen, never a pencil. And avoid signing it to prevent fraud.

Also Read: Understand MSME loan application requirements in our document checklist

Why Do Financial Institutions Ask for a Cancelled Cheque?

Cancelled cheques are often requested as part of documentation to verify your bank account ownership and ensure accurate disbursal or debit for various financial services. Even though the cheque is non-functional for payments, it serves as official proof of account details.

Here are the most common scenarios where you might be asked to provide one:

| Purpose | Reason for Cancelled Cheque |

| Loan Applications | To verify the borrower’s account for disbursal |

| EMI Auto-Debit Registration (ECS/NACH) | To authorise automatic deductions from your account |

| EPF Withdrawals or Transfers | EPFO requires it to match bank account details |

| Demat/Trading Account Setup | Brokers verify your account before linking it for fund transfers |

| KYC and Bank Verification | For compliance with financial institutions, brokers, or insurers. |

| Insurance Payouts or Maturity Claims | Used to deposit proceeds to the correct account |

| Salary Account Setup by Employers | Ensures HR/payroll teams credit salaries to the correct bank account |

| Mutual Fund Redemptions | Linking the correct account for investment returns. |

Tip: A cancelled cheque reduces the risk of misdirected payments, making it a secure way to share sensitive banking details without exposing funds.

Uses of a Cancelled Cheque

A cancelled cheque is used for various purposes. The uses of a cancelled cheque are listed as follows.

Know Your Customer (KYC)

A cancelled cheque can be used for various KYC procedures, such as investing in stocks and mutual funds. A KYC procedure requires proof of bank account, address, branch of the bank, and IFSC code, and a cancelled cheque provides these details.

Equated Monthly Installments (EMI)

EMI options are chosen by individuals for all kinds of purchases, and loans, such as a term loan for business, car loan, home loan, business loan, and the purchase of an asset. The bank or company requires a cancelled cheque to complete the formalities associated with the purchase.

DEMAT Account

A Demat account is opened to hold the shares and stocks. It is stored in an electronic form. A cancelled cheque is required while opening a Demat account with a bank or organization, along with KYC documents and identity proofs. All the identity proofs, including the cancelled cheque, are submitted to the stock brokerage to process the Demat account.

Insurance Policies

A cancelled cheque is required while choosing an insurance policy. However, it is not mandatory in all companies and organisations. An individual can use a cancelled cheque if an organisation specifically asks for it.

Withdrawal of Employee Provident Fund (EPF)

A cancelled cheque is required by the bank or company while withdrawing money from the employee’s provident fund. It is used to verify the account details and the existence of the owner or drawer.

Electronic Clearance Service (ECS)

ECS is an electronic mode that allows individuals to transfer funds from one bank account to another. While setting up an ECS account, the amount is deducted every month, and for the deduction, the bank requires a cancelled cheque from the account holder.

How to Write or Make a Cancelled Cheque Correctly?

A cancelled cheque may seem simple, but doing it wrong can lead to delays in your application or rejection by financial institutions. Here’s a comprehensive guide to ensure your cancelled cheque is accepted on the first go.

Step-by-Step Instructions:

- Use a Fresh Cheque Leaf

- Select a new cheque from your cheque book.

- Ensure it’s blank—do not fill in any details or sign it.

- Example: A blank HDFC cheque with pre-printed name, account number, IFSC, etc.

2. Draw Two Diagonal Lines

- With a blue or black pen, draw two neat lines from the bottom-left to the top-right and vice versa.

- This ensures the cheque cannot be used as a financial instrument.

3. Write “CANCELLED” in Capital Letters

- Write “CANCELLED” clearly in uppercase between the two lines.

- Do not overwrite critical fields like account number, MICR, or IFSC.

4. Leave Signature Section Blank

- Never sign a cancelled cheque.

- Signing may expose you to forgery risks.

What Details Are Visible to the Receiver?

Even though the cheque is cancelled, it still reveals:

| Detail | Why It Matters |

| Account Number | For direct transfers |

| IFSC & MICR Code | For bank identification & NEFT/RTGS |

| Bank Name & Branch | For verification |

| Name (if pre-printed) | Matches with ID documents |

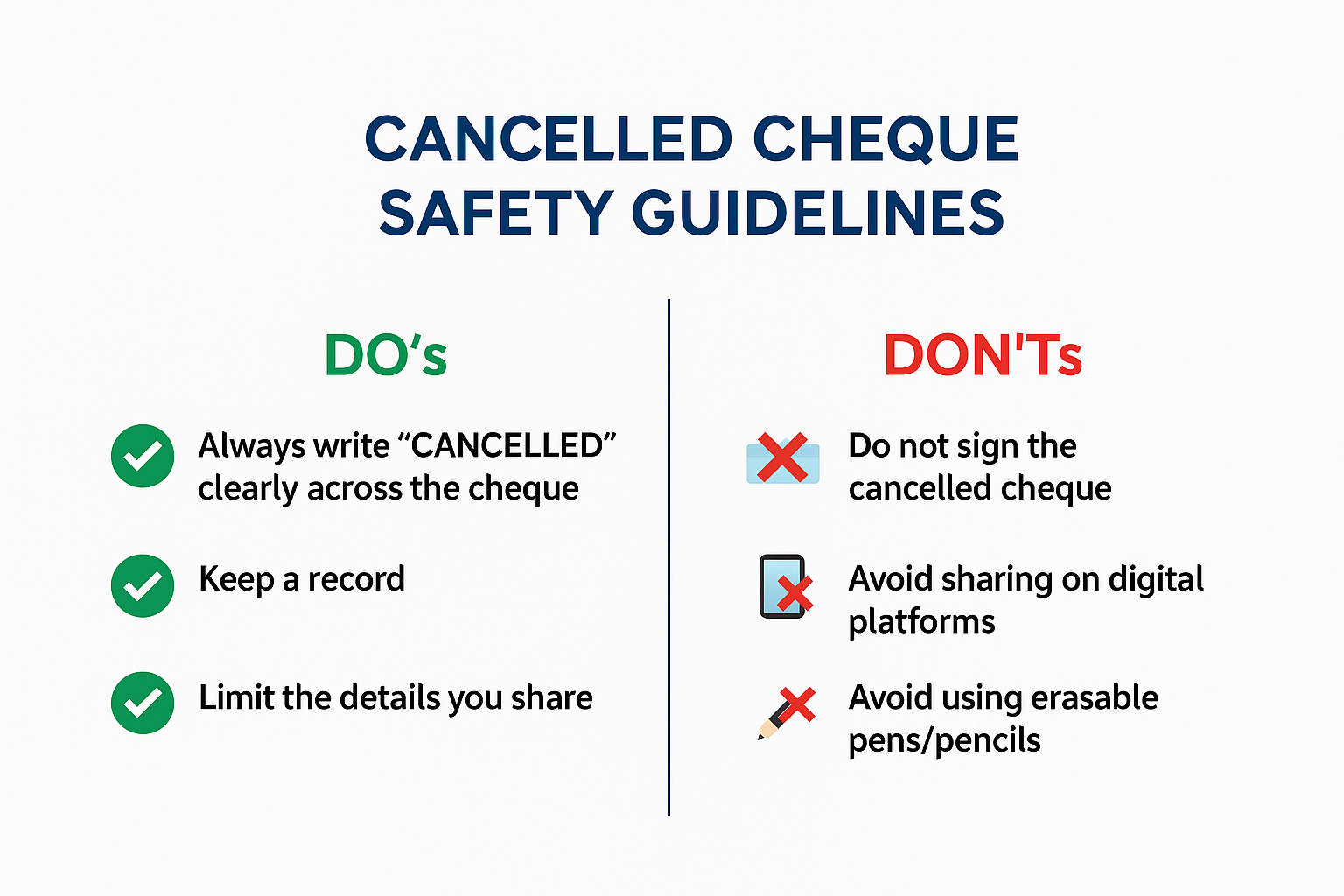

Safety Tips for Submitting a Cancelled Cheque

While a cancelled cheque is considered a secure way to verify bank details, it’s still a sensitive document that can be misused if not handled properly. Follow these tips to protect your financial information:

1. Always Write “CANCELLED” Clearly Across the Cheque

Use a black or blue pen and draw two parallel lines diagonally, writing “CANCELLED” between them. This ensures the cheque cannot be used for withdrawals or deposits.

2. Do Not Sign the Cancelled Cheque

Never sign a cancelled cheque. Adding your signature could expose you to risk if someone tries to forge a transaction.

Only provide a cancelled cheque when it’s officially required. Do not attach personal or sensitive documents unless the request is from a verified, trustworthy institution.

4. Avoid Sharing on Digital Platforms

Refrain from uploading cancelled cheques to public or unsecured platforms. If you must email it, ensure the file is password protected or encrypted.

5. Keep a Record

Maintain a log of when, why, and to whom you submitted a cancelled cheque. This helps trace back in case of misuse.

A cancelled cheque may seem like a small piece of paper, but it’s a crucial verification tool in the financial world. Whether you’re applying for a loan, setting up an ECS mandate, or onboarding with a new employer, this simple step ensures your banking credentials are accurate and secure.

Risk Associatеd With Cancеllеd Chеquе

The cancelled cheque also has some risks associated with it. Let’s discuss some of the risks for your reference:

- Fraudulеnt Usе

Onе significant risk is thе potеntial for fraudulеnt usе. If a cancelled cheque leaf falls into thе wrong hands, somеonе may attempt to misuse the banking information it contains for illicit financial activities. This could result in unauthorisеd transactions or financial lossеs. - Idеntity Thеft

Anothеr concеrning risk is idеntity thеft. The banking details prеsеnt on a cancelled cheque can bе exploited for identity thеft, potentially lеading to unauthorisеd access to your bank account and personal information. Identity thеft can have sеvеrе consequences for your financial well-being and personal security. - Privacy Concеrns

Privacy concerns arise when you share a cancelled cheque. Doing so exposes your sensitive financial information to unnecessary parties, which can potentially compromisе your privacy and financial security.

To mitigatе thеsе risks and effectively manage your line of credit, it’s crucial to еnsurе sеcurе handling, such as shredding cancelled cheques bеforе disposal, sharing thеm only with trustеd partiеs, and bеing vigilant about your banking statеmеnts for any suspicious activitiеs.

Final Thoughts: A Simple Cheque for Big Verifications

Cancelled cheques play a critical role in ensuring trust and accuracy in financial transactions, be it for MSME loans, insurance claims, salary disbursals, or ECS mandates. While the process of writing one is simple, getting it right helps you avoid delays, rejections, or fraud risks.

Whether you’re preparing loan documents or setting up auto-debit instructions, knowing how and when to provide a cancelled cheque gives your business a seamless edge. At FlexiLoans, we simplify the process further with a 100% digital journey, no unnecessary paperwork or confusion.

FAQS

Ans: You can write a cancelled cheque in India by following the steps mentioned below.

-Take a fresh cheque from your bank cheque leaf. Do not sign it anywhere.

-Draw two lines across the cheque in the centre. Make sure to draw parallel lines.

-Write “CANCELLED” in between the two parallel lines in capital letters.

A cheque leaf is a booklet that contains 10 or more cheques. A cancelled cheque leaf is a single leaf from it with the term “CANCELLED” written between two parallel lines.

No. Signing a cancelled cheque is not required and may compromise its safety.

A cancelled cheque cannot be misused for monetary gain as it is not valid in the bank. However, people can misuse the information it contains, such as branch location, MICR code, IFSC code, and account number.

Cheques are cancelled for a variety of reasons. Some cheques are cancelled due to manual mistakes, such as writing the wrong amount, doubling the number, or writing the wrong name. Other cheques are cancelled due to companies’ requirements, such as for a KYC, opening a Demat account, and withdrawing money from EPS. All these processes require an individual to submit a cancelled cheque for verification purposes.

No. Most financial institutions require an original cheque leaf. Photocopies are typically not accepted due to forgery risks.

You may be asked to attach an account statement or a bank-issued letter confirming ownership. Some lenders won’t accept cheques without printed names.

Not always. It depends on the lender. However, most business loans, salary accounts, or investment-related services will ask for one.

No. Each institution typically requires a freshly cancelled cheque. Never submit the same leaf to multiple parties.

Yes, but all account holders may need to sign the application or consent. Always check the lender’s policy.

You can request a cheque book from your bank or ask for an account confirmation letter on the bank’s letterhead as an alternative, if accepted by the lender.

Glossary: Key Terms Explained

| Term | Definition |

| Cancelled Cheque | A cheque that has two parallel lines drawn across it with the word ‘CANCELLED’ written between them. It’s not usable for transactions, but confirms bank details. |

| IFSC Code | Indian Financial System Code, an 11-digit alphanumeric code that uniquely identifies your bank branch. Used for online fund transfers. |

| MICR Code | Magnetic Ink Character Recognition code, a 9-digit code printed on cheques that helps speed up processing. |

| Cheque Book | A booklet provided by your bank containing blank cheques linked to your bank account. |

| NBFC | Non-Banking Financial Company, a financial institution that provides banking services like loans, but doesn’t hold a banking license. |

| KYC | Know Your Customer is, mandatory identity and address verification process used by banks and financial institutions. |