Jan 07, 2026

Feb 12, 2026

Discover how India’s Goods and Services Tax (GST) works, its types like CGST, SGST & IGST, and how it simplifies taxation and boosts business growth.

Authored By FlexiLoans | Date: 07/01/2026

- Quick Summary

- What: GST is a unified indirect tax in India that replaced multiple state and central taxes.

- Why: It simplifies compliance, reduces cascading taxes, and boosts transparency for both businesses and consumers.

- Who: Applicable to all Indian businesses and service providers crossing the registration threshold.

- How: Businesses must register under GST, issue compliant invoices, and file returns online via the GST portal.

- Use Case: GST helps MSMEs access business loans, file returns easily, and expand across states with unified taxation.

Introduction

Before the introduction of GST, India had a fragmented indirect tax system in which central and state governments levied multiple taxes on goods and services, including excise duty, VAT, and service tax. This layered structure made tax compliance for businesses complicated and time-consuming.

To simplify this, India implemented the Goods and Services Tax (GST) on July 1, 2017. GST is a unified indirect tax that replaced most existing central and state levies, bringing them under a single tax framework. More than just a tax reform, GST was designed to streamline compliance, reduce cascading taxes, and make doing business in India simpler and more efficient. Whether you’re buying or selling, GST plays a key role in ensuring transparency and consistency across the economy.

This guide breaks down GST types, structure, compliance, and how it benefits businesses in 2026.

What is GST?

GST full form stands for Goods and Services Tax. The GST, on the other hand, refers to a single indirect tax that replaces other indirect taxes like the excise duty, VAT, service tax, and more. Both the central and state governments impose it on the goods and services that are sold for consumption within India.

This destination-based tax is levied at the place of consumption, not the place of origin, thus removing biases towards producing states and ensuring fair distribution of tax revenue. As GST unifies multiple taxes into a single system, it simplifies overall business operations, as well. These include less paperwork, single registration, and no cascading of taxes.

As GST unifies multiple taxes into a single system, it simplifies overall business operations, as well. These include less paperwork, single registration, and no cascading of taxes.

Key Components of GST

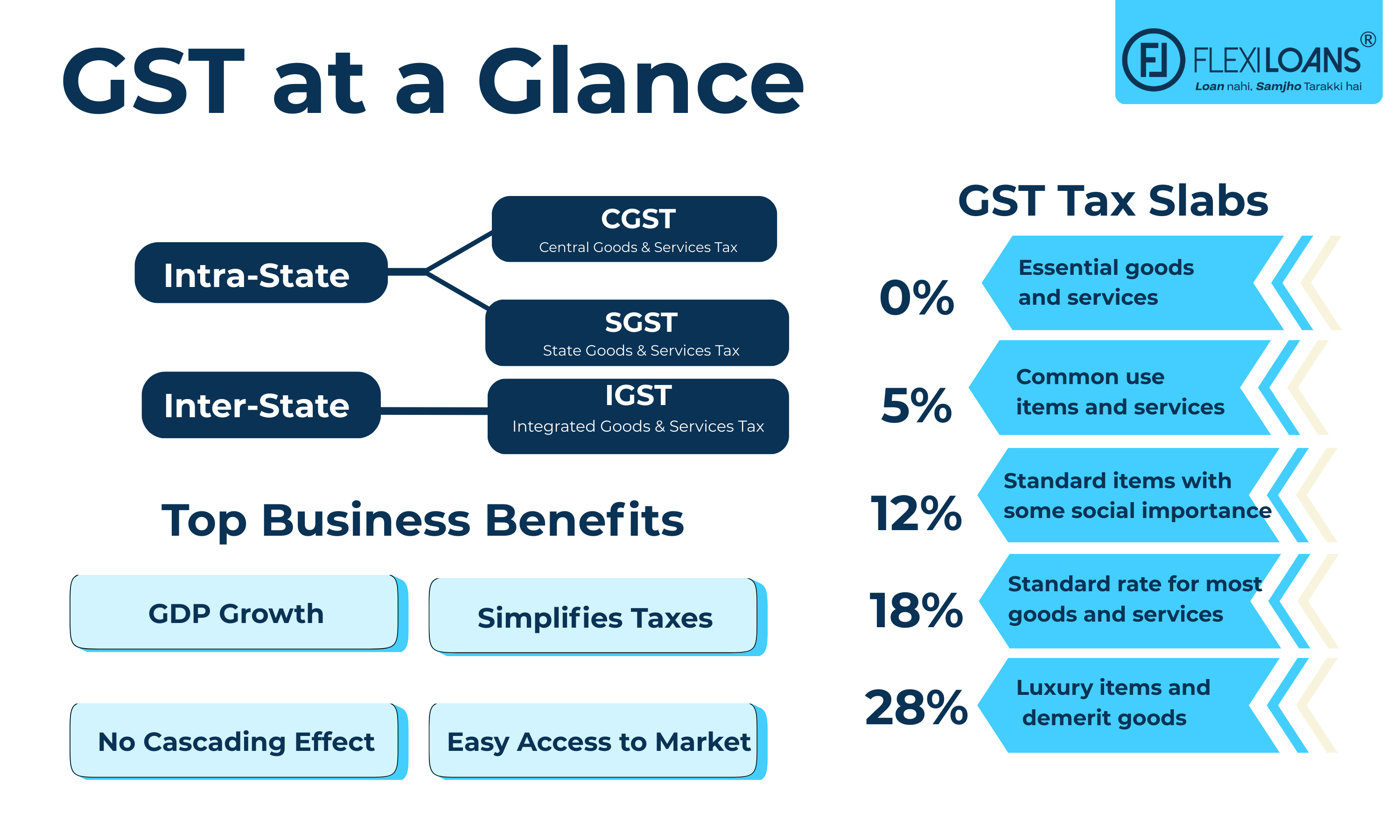

With the GST introduction, there arose issues on how to divide GST between the state and central government. Here are the components of GST that ease the tax distribution challenge and address the taxation requirements of both the state and central government:

- CGST: CGST full form is Central GST. The central government of India governs it and applies it to intra-state supplies. CGST replaces service tax, some customs duties, and central excise duty.

- SGST: SGST full form is State GST. The state government governs this tax system and applies it to intra-state (within states) supplies of goods. It replaces central sales tax, the luxury tax, state VAT, and entertainment tax.

- IGST: IGST full form is Integrated GST. It is imposed on imports, exports, and interstate (between states) supplies of goods and services. The central government of India governs this GST framework in India.

GST Introduction in India

The history of GST dates back to 2014 when India introduced the first GST bill as the Constitution Bill in 2014 (122 Amendment). Before GST in India, indirect taxes like VAT, customs duty, and service tax made it difficult for businesses to grow, manage costs, and stay competitive.

To fix this problem, Rajya Sabha approved the bill in 2016 and got it renamed The Constitution Act, 2016 (101st Amendment). In September, the GST Council was set up, and the 1st GST Council meeting was held.

In May 2017, the GST Council recommended all the rules. And finally, the Prime Minister of India, with the consent of the former finance minister and the President, along with the GST council, introduced GST on July 1, 2017.

With the GST introduction in India, moving goods and services became easier. Moreover, it reduced the overall tax burden on businesses. GST also introduced a digital tax filing system, making the process simpler and quicker.

Timeline and History of GST

- 2000: Prime Minister Atal Bihari Vajpayee set up a committee to draft GST law.

- 2004: A task force concludes that GST must be included to improve the tax structure

- 2006: Finance Minister proposes GST introduction from April 1, 2010

- 2007: GST phased out and rates reduced from 4% to 3%

- 2008: EC finalises dual GST structure

- 2010: GST implementation postponed

- 2011: The Constitution Amendment Bill was introduced to enable GST

- 2012: Standing committee begins discussion on GST, but stalled it over clause 279B

- 2013: Standing committee submits its GST report

- 2014: Reintroduction of the GST bill in parliament

- 2015: GST bill passed in Lok Sabha but not in Rajya Sabha

- 2016: GSTN goes live, and amended model passed in Lok and Rajya Sabha

- 2017: Rajya sabha passes four supplementary GST bills and GST goes live on July 1

- 2018: Ministry of Finance started releasing monthly GST revenue

Types of GST

There are three types of GST in India. Each GST category carries down a particular type of transaction.

1. State GST (SGST)

This tax applies to transactions on the sale of goods and services within the same state. For example, if you are running a clothing store in Maharashtra and sell a dress worth ₹10,000 to a customer of Maharashtra itself, the applicable GST rate will be 5%, including CGST and SGST. Here, the state GST rate will be 2.5%, and the calculation will be as follows:

SGST = (SGST rate/100) × Sale value

SGST = (2.5/100) × 1000 = ₹250

2. Central GST (CGST)

As outlined by the CGST Act of 2017, Central GST charges tariffs on the sale of intra-state goods and services. Under the GST framework, CGST applies to transactions within the same state. It just ensures that the central government receives its tax revenue generated from intrastate supplies.

For example, if you run an apparel company in Tamil Nadu that sells a dress to a customer belonging to the same state, CGST will be applicable to the transaction. Considering the GST rate as 18%, the total GST will turn out to be ₹1800 when the dress is sold at ₹10,000. So, the CGST rate will be 9% as CGST and SGST are half of the total GST rate each for intra-state (within the same state) sales.

GST = Value of Goods x GST rate /100

GST = ₹10,000 x 18% / 100 = ₹1800

CGST = GST amount / 2 (when rates of CGST and SGST are equal)

CGST = ₹1800 / 2 = ₹900

3. Integrated GST

As outlined by the IGST Act of 2017, integrated GST applies to the sale of inter-state supply of goods and services. The Central government governs the integrated GST as the central and state governments share the entire cess.

For example, if you are a seller in Tamil Nadu who sells goods worth ₹10,000 to a customer in Maharashtra, the IGST will be at 18% as per the GST policies. The calculation will be as follows:

IGST = (Cost of Good sold) x (IGST Rate/100)

= ₹10,000 x (18/100)

= ₹1,800

Here, 900 extends to the central government and the other half to the receiving state, i.e. Tamil Nadu.

GST isn’t just a tax reform. It’s the backbone of a unified economy, empowering businesses, encouraging transparency, and simplifying compliance.

Benefits of GST

The GST in India has benefited both businesses and customers in several ways. Here are the most prominent GST advantages you must know:

1. Easy Access to Market

The best GST impact on businesses is that they can now enjoy easy access to different markets. Different taxes in different states, including central, made it harder to move goods and services. The destination-based tax regime and easy movement of goods between states help businesses reach more customers, increasing their growth opportunities.

2. No Cascading Effect

Earlier, every buyer, including the final consumer, used to pay tax on tax. It was called the cascading effect. As GST is applicable only to the net value at every stage of the supply chain, it has helped remove tax barriers in businesses.

3. More Competitiveness

As the tax system under GST is maintaining online records, it has led to enhanced transparency and accountability within the GST framework. This increased transparency and reduced cost has increased the competitiveness between businesses in India and abroad.

4. Simplified Tax Payments

GST filing occurs at one single centralised platform. With this fixed-rate structure, it’s easier to understand the tax on products and services. Moreover, an online platform for tax payment makes the process faster and easier.

5. Business Loans

Banks, NBFCs, and lenders look at the GST returns before providing a business loan to MSMEs (Medium and small-scale enterprises). This makes it easy for small businesses to meet the business loan eligibility criteria and get financing. Better tax returns may result in higher MSME loans.

6. GDP Growth

The implementation of GST in India has simplified the tax system by eliminating multiple-point taxation and reducing tax rates. As a result, trade, commerce, and science exports grow. Experts say that GST in India has boosted GDP to 6.5% in 2024-25 and reduced inflation up to 2%.

7. Improved Ease of Doing Business

By eliminating the need for multiple state-level tax laws, GST has helped businesses expand across borders. The unified tax system will help you to streamline business operations and make cost savings for your startup.

GST Structure and Components

The GST Council of India manages the GST structure, consisting of four-tier tax slabs: 5%, 12%, 18%, and 28%, respectively. With a proper understanding of GST tax systems, you successfully follow the rules, lessen tax burden, and manage your business honestly. Here is a detailed overview of GST rates under the GST structure:

Tax Slabs in India

| Slab Rate | Type of Goods/Services | Examples |

| 0% (Nil Rate) | Essential goods and services | Fresh vegetables, milk, eggs, health services, education |

| 5% | Common use items and services | Edible oil, sugar, tea, coffee, transport services, LPG (domestic) |

| 12% | Standard items with some social importance | Butter, ghee, mobile phones, diagnostic kits, processed food |

| 18% | Standard rate for most goods and services | Soaps, toothpaste, ACs, restaurant services (non-AC), insurance |

| 28% | Luxury items and demerit goods | Cars, tobacco, pan masala, aerated drinks, high-end electronics |

GST Registration Turnover Limit

As an owner, you should know the threshold turnover limit for GST registration of your business. Here is an overview of it:

| Business Type | Aggregate turnover (Normal State) | Aggregate turnover (Category State) |

| Traders and Suppliers | 40 lakhs | 20 lakhs |

| Manufacturers | 20 lakhs | 10 lakhs |

| Service Providers | 20 lakhs | 10 lakhs |

| Composition Scheme (Small service providers) | 50 lakhs | 50 lakhs |

Category states include Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh, Uttarakhand, Jammu Kashmir, and Ladakh.

Tax returns under GST Regime

There are various tax returns under the GST regime. However, every return depends on the type of taxpayer and the nature of GST registration. Here are the details:

- GSTR-1: Applicable for reporting sales and outward supplies.

- GSTR-3B: A summary return consisting of total tax paid, input tax credit (ITC) claimed and inward/outward supplies.

- GSTR-4: This requires businesses to provide a summary of tax payable and outward supplies.

- GSTR-5: It applies to business owners who are non-resident Indians (NRIs).

- GSTR-6: It is applicable for input service distributors.

- GSTR-7: It is applicable when the GST for your service is deducted at the source.

- GSTR-8: It applies to e-commerce operators who collect tax on the goods sold.

- GSTR-9: It is applicable for businesses and normal taxpayers registered under the GST system.

- GSTR-10: It is the final return applicable for taxpayers whose registration is cancelled.

- GSTR-11: Applicable to persons having a Unique Identity Number (UIN), claiming refund of taxes paid on purchases.

GST Compliance Requirements

To make sure that your business follows GST compliance, follow this simple step-wise checklist. This will help you meet GST laws and avoid penalties.

| Steps | Description | Frequency |

| GST Registration |

|

Only once (During registration) |

| Tax Invoicing |

|

Ongoing |

| GST Return Filing | File GST returns related to sales and tax liabilities. | Monthly (11th of the next month)Quarterly (13th of the next month following the quarter) |

| GST Record Maintenance | Maintain accurate records of tax payments, credits, sales, and purchases for 6 years. | Ongoing |

| Annual Return GST Filing | File annual return (GSTR-9) | By 31st December (annually) |

| Regular Updates | Keep checking the GST portal for updates on new tax slabs or changes in regulations. | Ongoing |

| GST Reconciliation | Match all your invoices and payments with the records on the GST Portal, ensuring accuracy. | Monthly or Quarterly |

Conclusion

GST’s One Tax, One Nation concept has significantly impacted businesses and the economy as a whole. Though it can be challenging for small businesses as the increased costs and compliance burden can attract penalties, MSMEs must understand and adapt to GST requirements & regulations. Proper adaptation paves the way for an efficient tax system, making your business more transparent.

If your business passes the turnover threshold, make sure to go ahead with GST registration. File your GST returns on time to keep your records clean and hassle-free. As the GST New Rules 2026 introduced frequent updates like E-Way Bill (EWB) validity and the introduction of Form GST DRC-03A, it’s best to consult a professional tax advisor.

FAQs

GST stands for Goods and Services Tax. It is a unified indirect tax levied on the supply of goods and services, replacing multiple state and central taxes like VAT, service tax, and excise duty.

GST was introduced to eliminate the cascading effect of taxes, simplify the indirect tax structure, enable seamless interstate trade, and promote transparency in business transactions.

There are three types of GST:

1. CGST (Central Goods and Services Tax)

2. SGST (State Goods and Services Tax)

3. IGST (Integrated Goods and Services Tax)

Each type applies based on the nature of the transaction (intra-state or inter-state).

Unlike the old system with multiple indirect taxes, GST creates a single tax structure. It allows input tax credit across the value chain and applies uniformly across India, improving ease of doing business.

India follows a four-tier GST rate structure: 5%, 12%, 18%, and 28%, depending on the nature of the goods or services. Essential goods are either exempt or taxed at lower rates, while luxury items fall in the higher slabs.

GST registration is mandatory once a business exceeds the applicable turnover threshold, which varies by nature of supply, state, and business category. Certain companies are required to register irrespective of turnover.

GST reduces compliance complexities, helps access credit, and builds trust with lenders. For MSMEs, proper GST return filing is often a key factor in business loan eligibility.

Yes, freelancers, consultants, and professionals earning beyond the threshold must register and pay GST. They can also claim input tax credit on eligible expenses.

In intra-state sales, GST is split evenly between CGST (central) and SGST (state). For example, a product with 18% GST will have 9% CGST and 9% SGST.

GST promotes GDP growth, enhances tax compliance, boosts exports, and creates a single national market, benefiting businesses and consumers alike.

Glossary: Key Terms Explained

| Term | Meaning |

| GST | Stands for Goods and Services Tax, a unified indirect tax in India. |

| GST stands for | Goods and Services Tax – applicable on supply of goods and services. |

| GST meaning | GST refers to a single tax replacing VAT, excise, and service tax. |

| CGST | Central Goods and Services Tax, levied by the central government on intra-state supplies. |

| SGST | State Goods and Services Tax, levied by the respective state on intra-state transactions. |

| IGST | Integrated Goods and Services Tax, charged on inter-state and import/export transactions. |

| GST Council | The governing body that recommends GST laws and rates in India. |

| Input Tax Credit (ITC) | Credit businesses can claim on GST paid for purchases used to make taxable supplies. |

| GST Registration | A process through which businesses obtain a GSTIN to legally collect and file GST. |

| Tax Slabs | Predefined GST rates (0%, 5%, 12%, 18%, 28%) based on product/service categories. |

| Composite Scheme | A simplified GST scheme for small taxpayers with a lower compliance burden. |

| GSTR-1 / GSTR-3B / GSTR-9 | Types of GST returns filed periodically by registered taxpayers. |

Is this information helpful?